Driven by an innovative and sophisticated rules engine, Advantage Payment System (APS) enables the automation of a multitude of local and international standards-based payments in a highly flexible, configurable and secure manner.

SOLUTIONS

AUTOMATED PAYMENT PROCESSING

Increase efficiency & minimize risk

Streamline payment processing

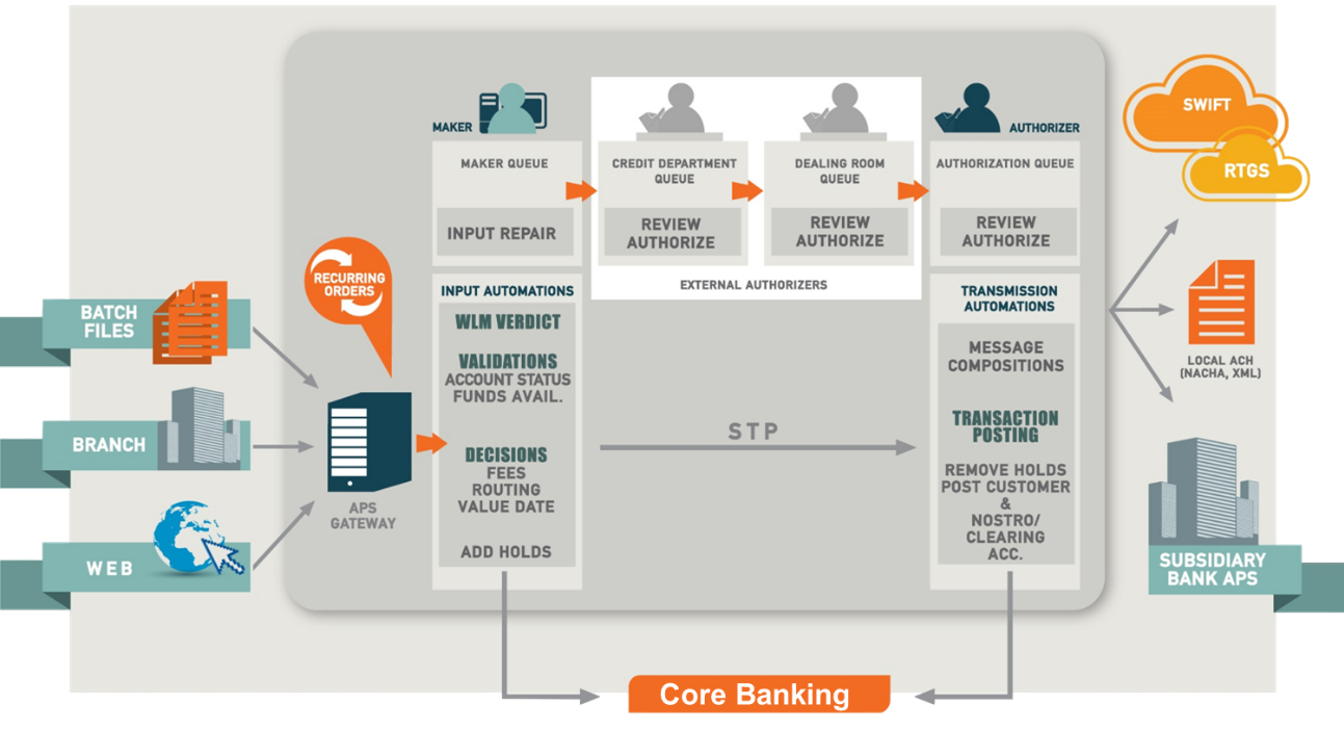

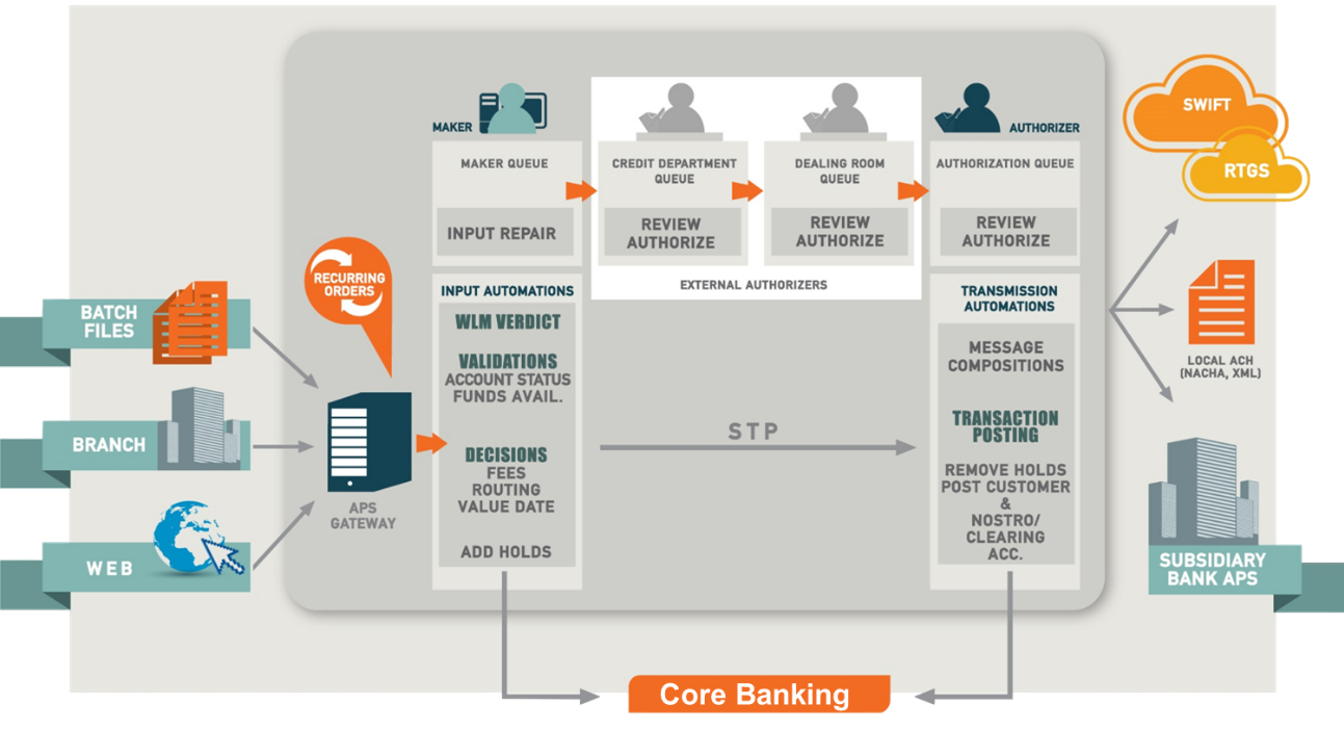

APS eliminates time-consuming and error-prone manual processing of payment orders by bank employees via automating business requirements and integrating with existing cross-enterprise core systems while applying complex security schemas and monitoring workflows covering:

- Highly configurable Straight Through Processing (STP) and auto-authorization rules based on currency, amount, special rate rules, transaction type, etc.

- Maker/ Authorizer workflows that offer a highly secure yet efficient operations model and exceptions handling

- End-to-End accounting entries on customer accounts, Nostro accounts, relevant income/ tax GL accounts

Streamline payment processing

APS eliminates time-consuming and error-prone manual processing of payment orders by bank employees via automating business requirements and integrating with existing cross-enterprise core systems while applying complex security schemas and monitoring workflows covering:

- Highly configurable Straight Through Processing (STP) and auto-authorization rules based on currency, amount, special rate rules, transaction type, etc.

- Maker/ Authorizer workflows that offer a highly secure yet efficient operations model and exceptions handling

- End-to-End accounting entries on customer accounts, Nostro accounts, relevant income/ tax GL accounts

Support all channel & transfers

By supporting multiple origination points (i.e. uploaded batch files, bank branches and internet banking) APS is a centralized payments hub that covers the full spectrum of transfers & payments including:

- Individual and bulk payments

- Future dated and recurring transfers

- Bill Payments and Biller Management

- Direct Debits and Mandates Management

Support all channel & transfers

By supporting multiple origination points (i.e. uploaded batch files, bank branches and internet banking) APS is a centralized payments hub that covers the full spectrum of transfers & payments including:

- Individual and bulk payments

- Future dated and recurring transfers

- Bill Payments and Biller Management

- Direct Debits and Mandates Management

Serve your customers at the right time

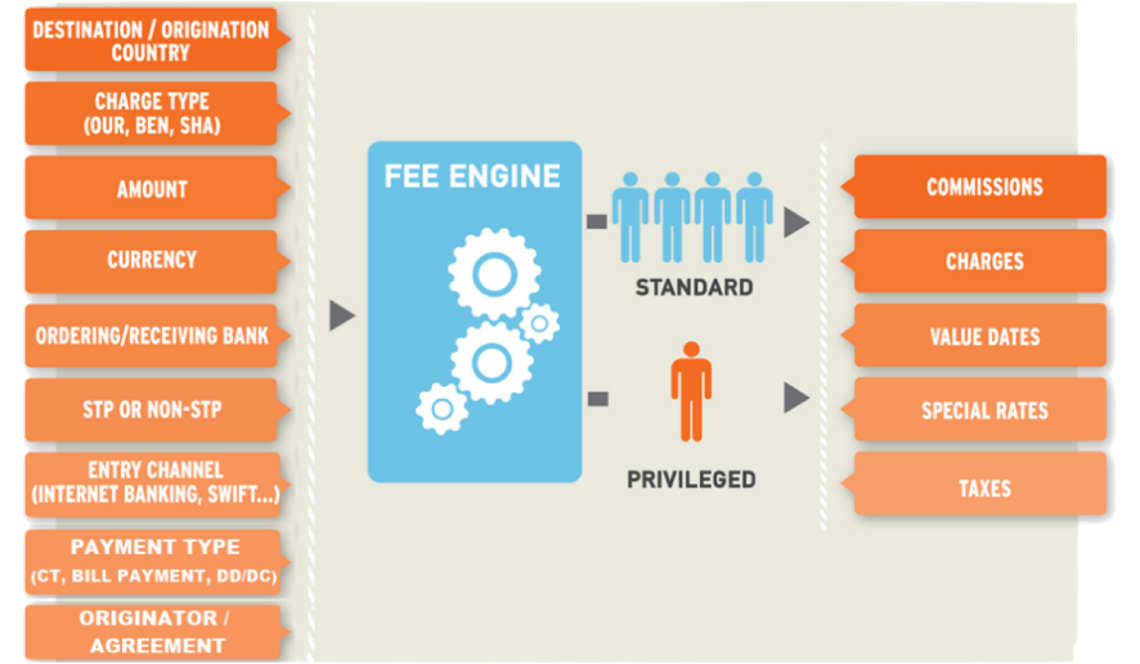

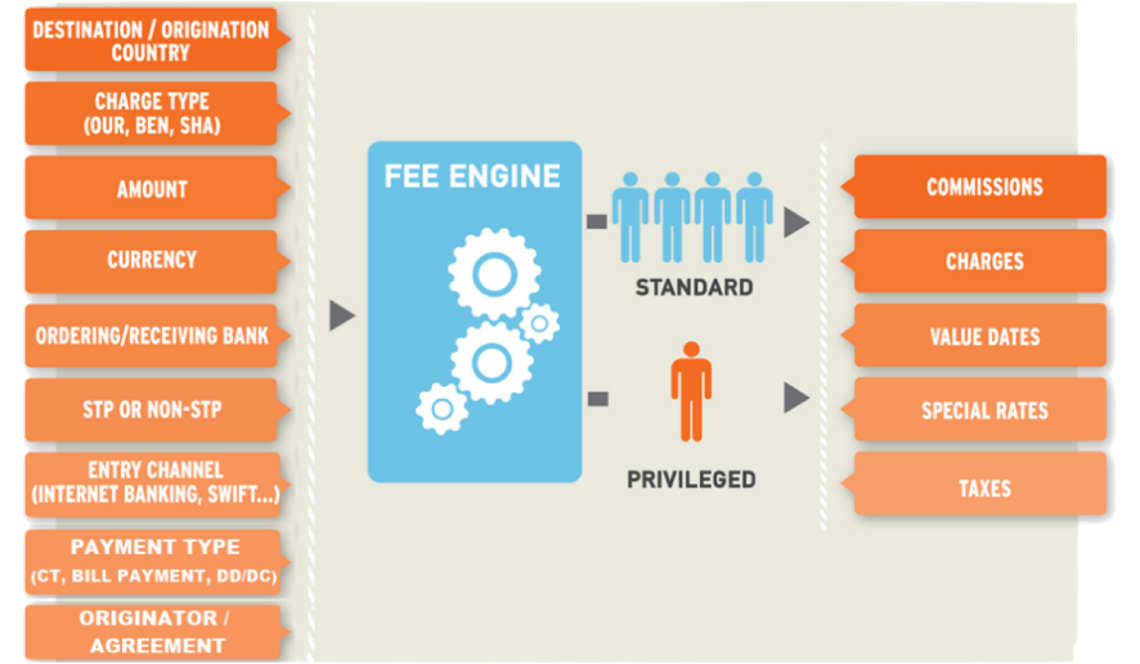

Through the configurable pricing engine incorporated in APS you may easily apply your own set of rules relating to commissions, charges, special rates, value dates, taxes as well as define your own advanced pricing schemes:

- Per channel (originating and/or outward)

- Per currency and/or amount

- Per biller

- Per customer

Serve your customers at the right time

Through the configurable pricing engine incorporated in APS you may easily apply your own set of rules relating to commissions, charges, special rates, value dates, taxes as well as define your own advanced pricing schemes:

- Per channel (originating and/or outward)

- Per currency and/or amount

- Per biller

- Per customer

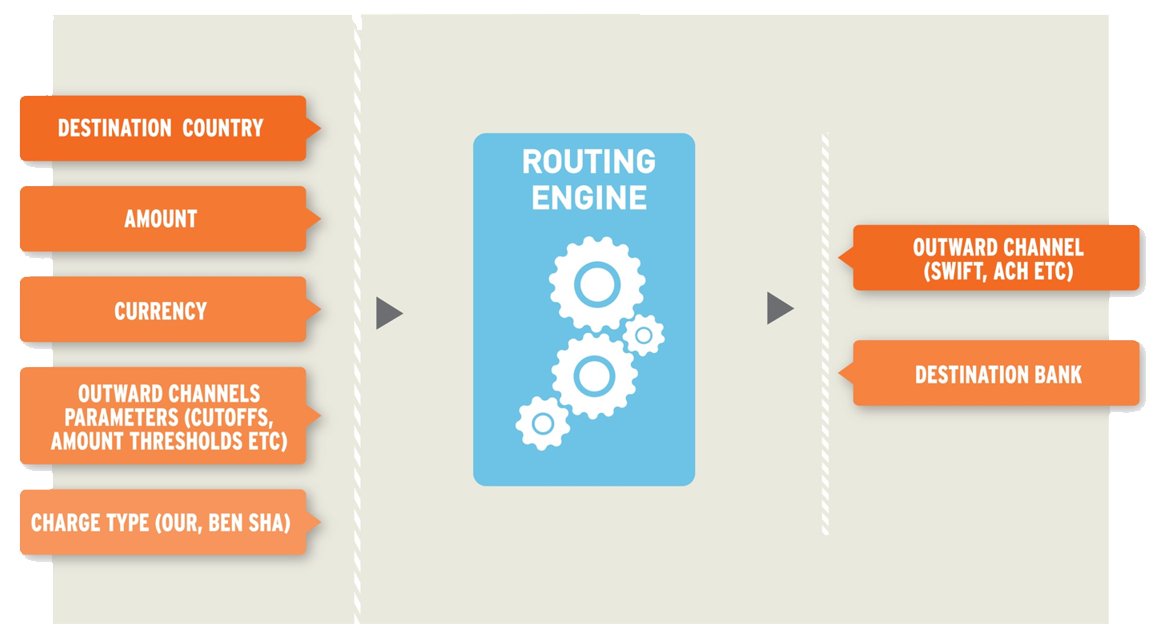

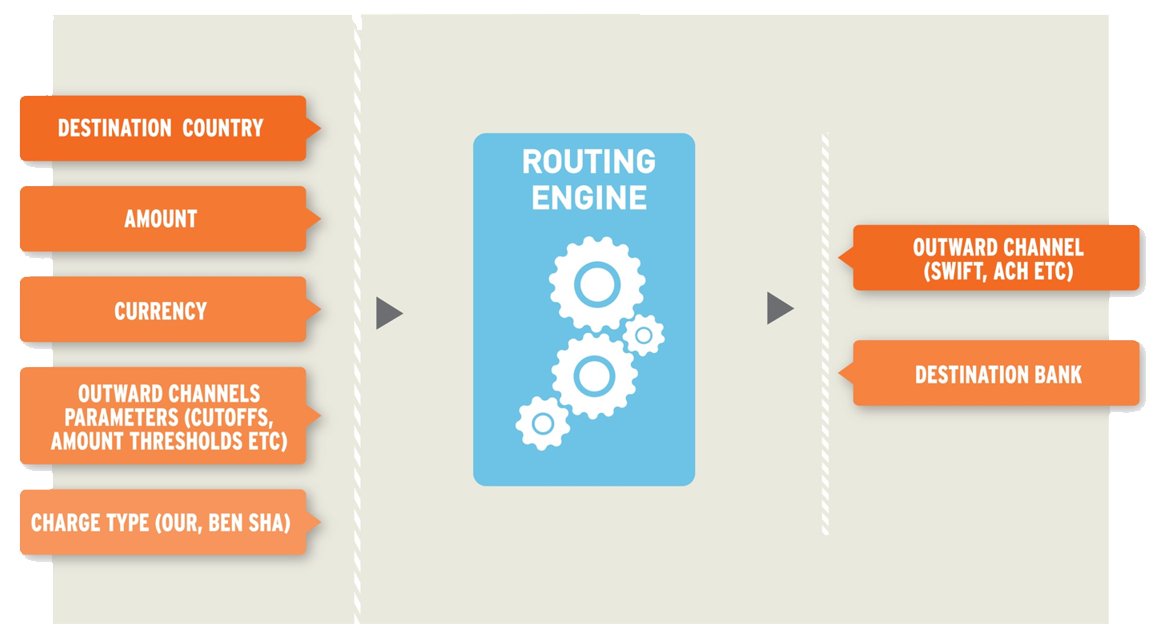

Conduct payments across the globe

Whether relying on correspondence banking or opting for direct connection to nationwide an international payment networks APS’ advanced rooting engine ensures the proper handling of your payment orders with a wide range of options covering:

- Incoming & Outgoing SWIFT credit transfers (MT103(+), MT202COV)

- Incoming & Outgoing Local ACH/ RTGS/ Intra-group credit transfers & returns

- SEPA credit transfers and direct debits(ISO 20022)

- Real time Instant Payments initiatives

Conduct payments across the globe

Whether relying on correspondence banking or opting for direct connection to nationwide an international payment networks APS’ advanced rooting engine ensures the proper handling of your payment orders with a wide range of options covering:

- Incoming & Outgoing SWIFT credit transfers (MT103(+), MT202COV)

- Incoming & Outgoing Local ACH/ RTGS/ Intra-group credit transfers & returns

- SEPA credit transfers and direct debits(ISO 20022)

- Real time Instant Payments initiatives

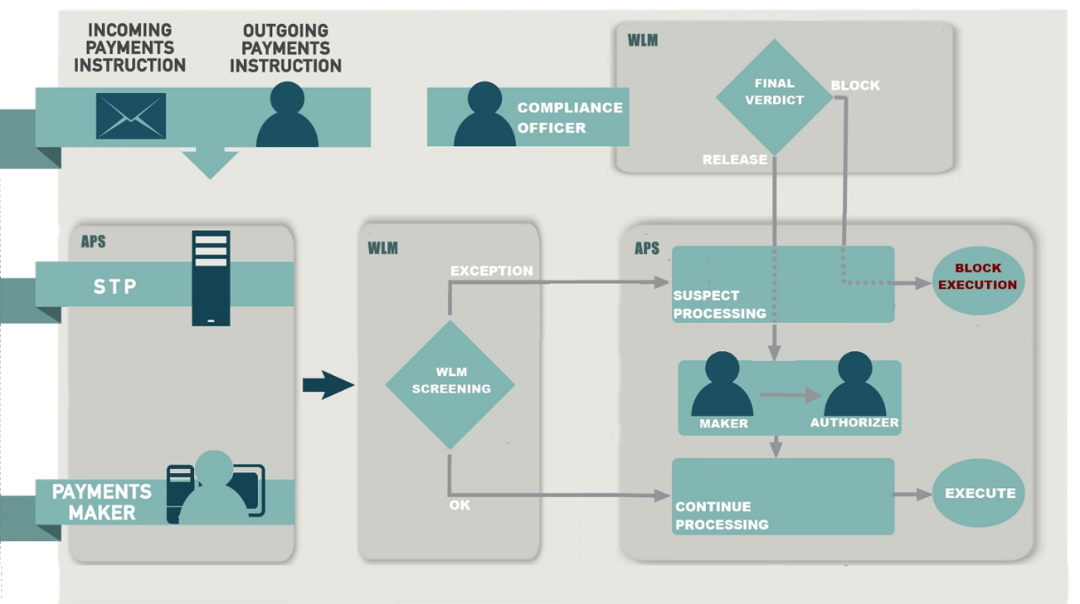

Comply to Regulations and ensure peace of mind

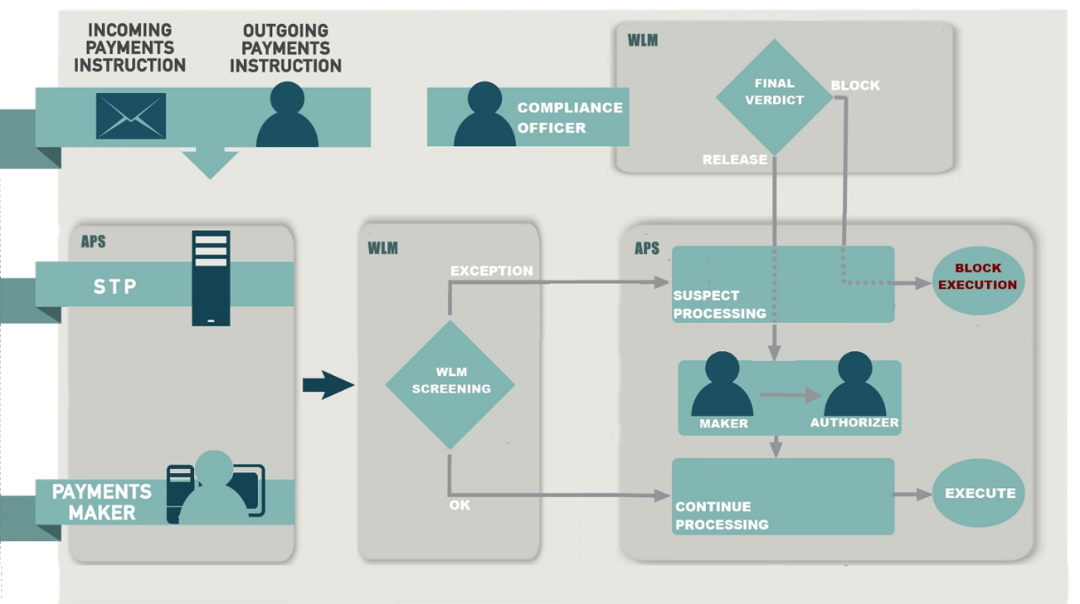

APS seamlessly enables WLM screening of payments as part of its payment validation process (via integration with AML systems), aiming to reduce manual processing and increase security for the Bank and its customers.

APS is preintegrated with Fiserv FCRM, Norcom and Safewatch

Comply to Regulations and ensure peace of mind

APS seamlessly enables WLM screening of payments as part of its payment validation process (via integration with AML systems), aiming to reduce manual processing and increase security for the Bank and its customers.

APS is preintegrated with Fiserv FCRM, Norcom and Safewatch