Quick. Customizable. Easy to implement.

SOLUTIONS

CUSTOMER ONBOARDING

From prospect to customer in under 5’

Deliver captivating journeys

Support all customer touchpoints

Let customers self-onboard from their homes

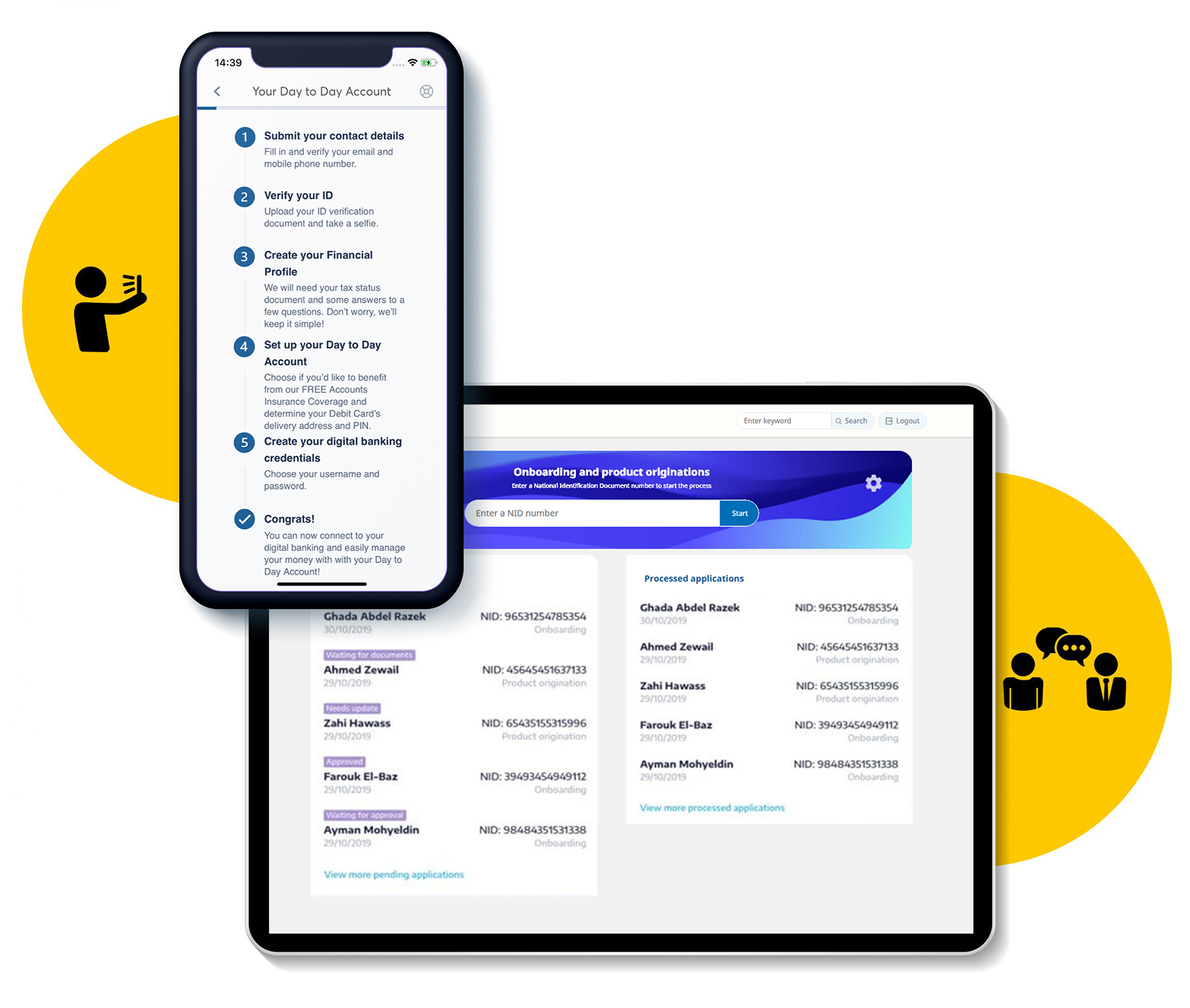

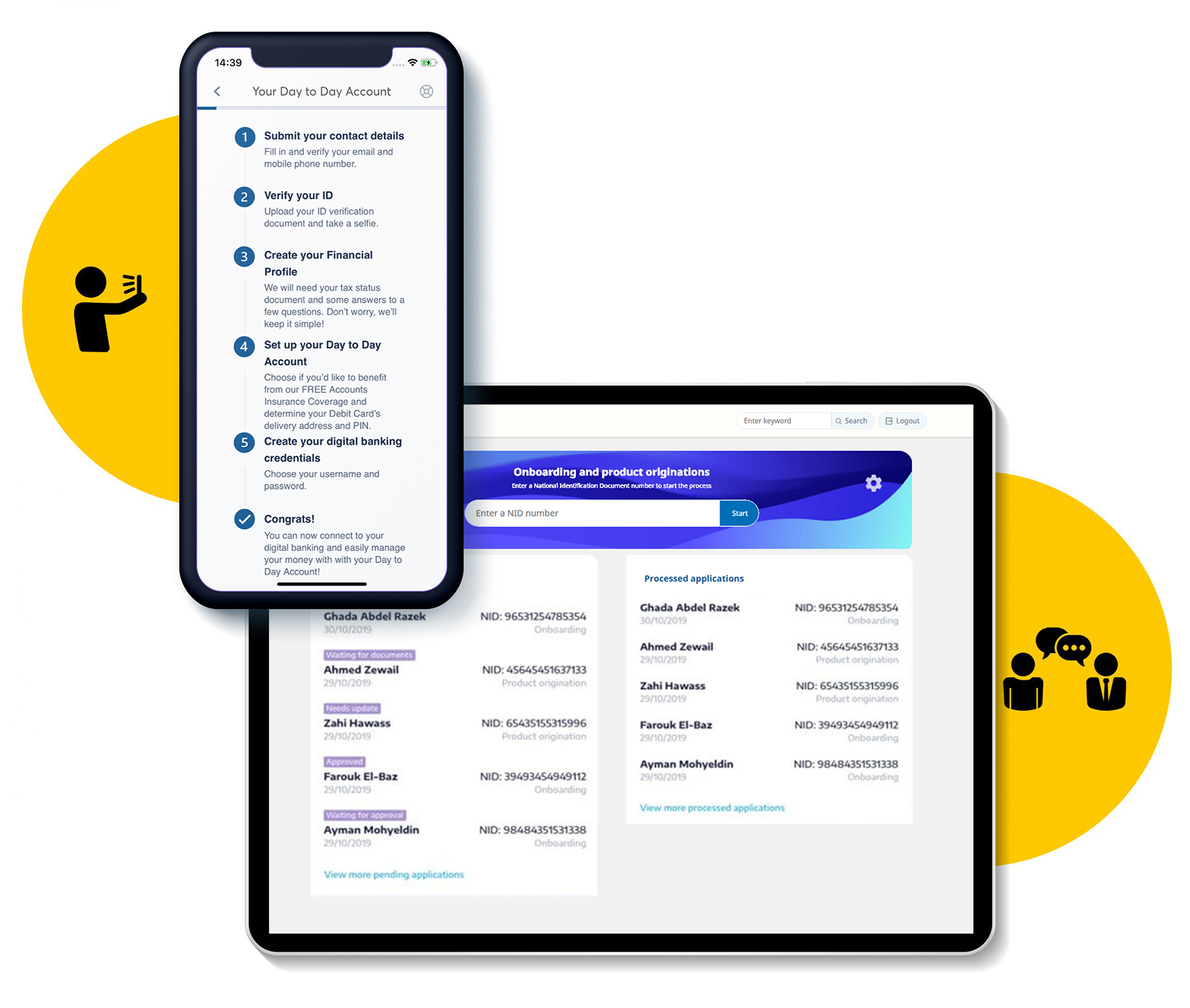

Deliver journeys to end-customer devices (iOS & Android native applications, web browsers), with seamless switching between them. Customers can start on one channel, save their application, and resume on another channel.

Let customers quickly onboard in-branch

Offer customer onboarding and product originations by bank employees, within, or outside of the branch. Bridge bank silos and offer seamless branch onboarding, including approvals (4-eyes principle), user management, and signing contractual documents.

Support all customer touchpoints

Let customers self-onboard from their homes

Deliver journeys to end-customer devices (iOS & Android native applications, web browsers), with seamless switching between them. Customers can start on one channel, save their application, and resume on another channel.

Let customers quickly onboard in-branch

Offer customer onboarding and product originations by bank employees, within, or outside of the branch. Bridge bank silos and offer seamless branch onboarding, including approvals (4-eyes principle), user management, and signing contractual documents.

Create end-to-end onboarding experiences

Your bank’s onboarding journey is unique.

Omnia helps you combine product discovery and personalization, capturing customer data (contact, financial, employment), validating ID documents and identity, configuring the product, and cross-selling complimentary products. Finish, in under 5 minutes, with a new customer, already enrolled for digital banking.

Omnia comes with a rich set of pre-configured steps that can be re-used to accelerate the delivery of compelling customer journeys:

- Product calculators

- Mobile phone and email validation

- Document scanning

- Progress indicators

- Save and resume an ongoing application

- Switch between channels (web, mobile)

- Alerts & notifications

Create end-to-end onboarding experiences

Your bank’s onboarding journey is unique.

Omnia helps you combine product discovery and personalization, capturing customer data (contact, financial, employment), validating ID documents and identity, configuring the product, and cross-selling complimentary products. Finish, in under 5 minutes, with a new customer, already enrolled for digital banking.

Omnia comes with a rich set of pre-configured steps that can be re-used to accelerate the delivery of compelling customer journeys:

- Product calculators

- Mobile phone and email validation

- Document scanning

- Progress indicators

- Save and resume an ongoing application

- Switch between channels (web, mobile)

- Alerts & notifications

Comply with regulatory requirements

Different regulations apply in each country. With Omnia onboarding you can:

- Use one of the pre-integrated eKYC third-party vendors, or select your preferred eKYC provider, regarding ID document capture and liveness detection.

- Include video calls as appropriate, or require the customer to visit the branch if necessary.

- Connect to AML / WLM lists.

- Cover FATCA, CRS, GDPR requirements.

- Upload complimentary documents (proof of address, proof of income).

- Digitally sign contractual documents.

Comply with regulatory requirements

Different regulations apply in each country. With Omnia onboarding you can:

- Use one of the pre-integrated eKYC third-party vendors, or select your preferred eKYC provider, regarding ID document capture and liveness detection.

- Include video calls as appropriate, or require the customer to visit the branch if necessary.

- Connect to AML / WLM lists.

- Cover FATCA, CRS, GDPR requirements.

- Upload complimentary documents (proof of address, proof of income).

- Digitally sign contractual documents.

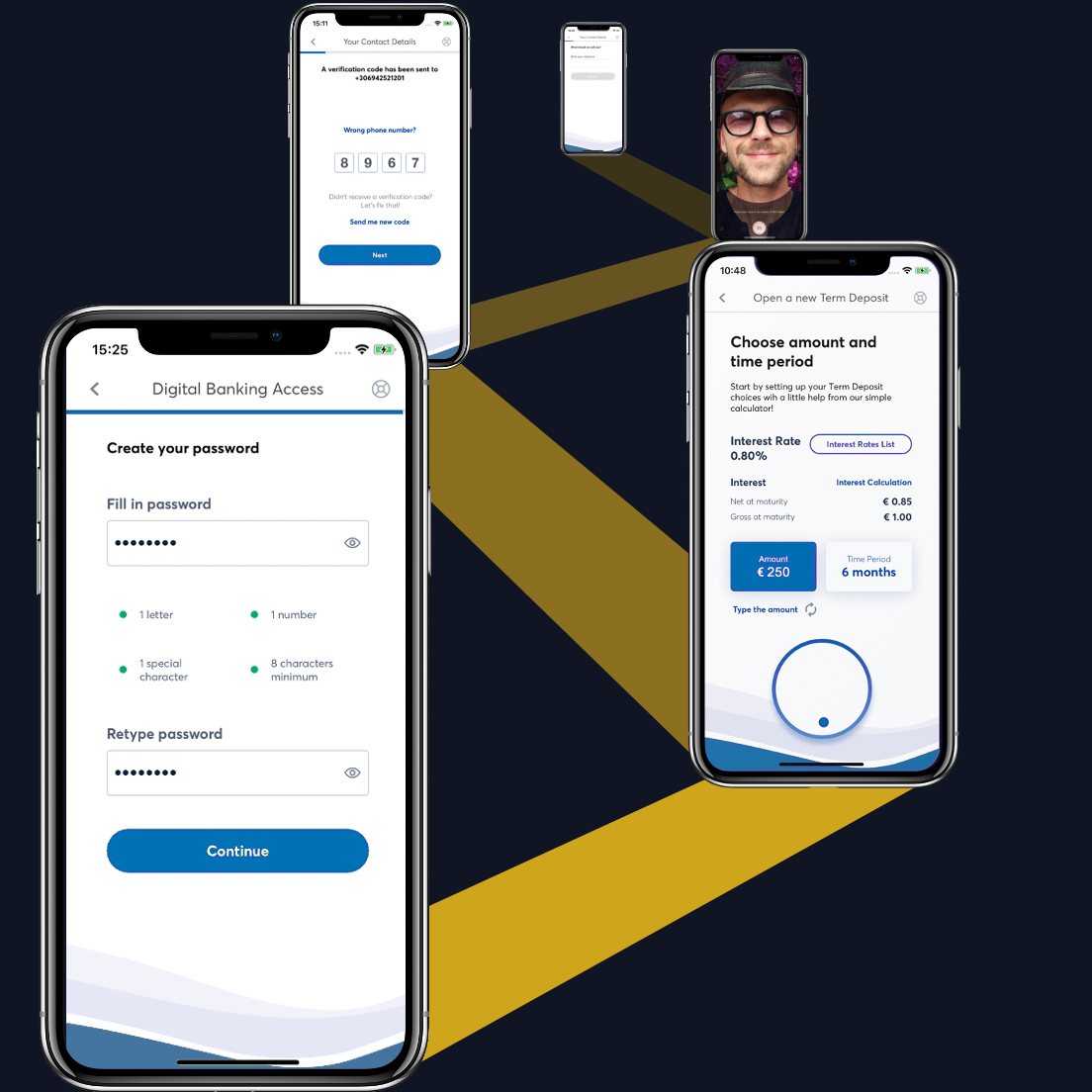

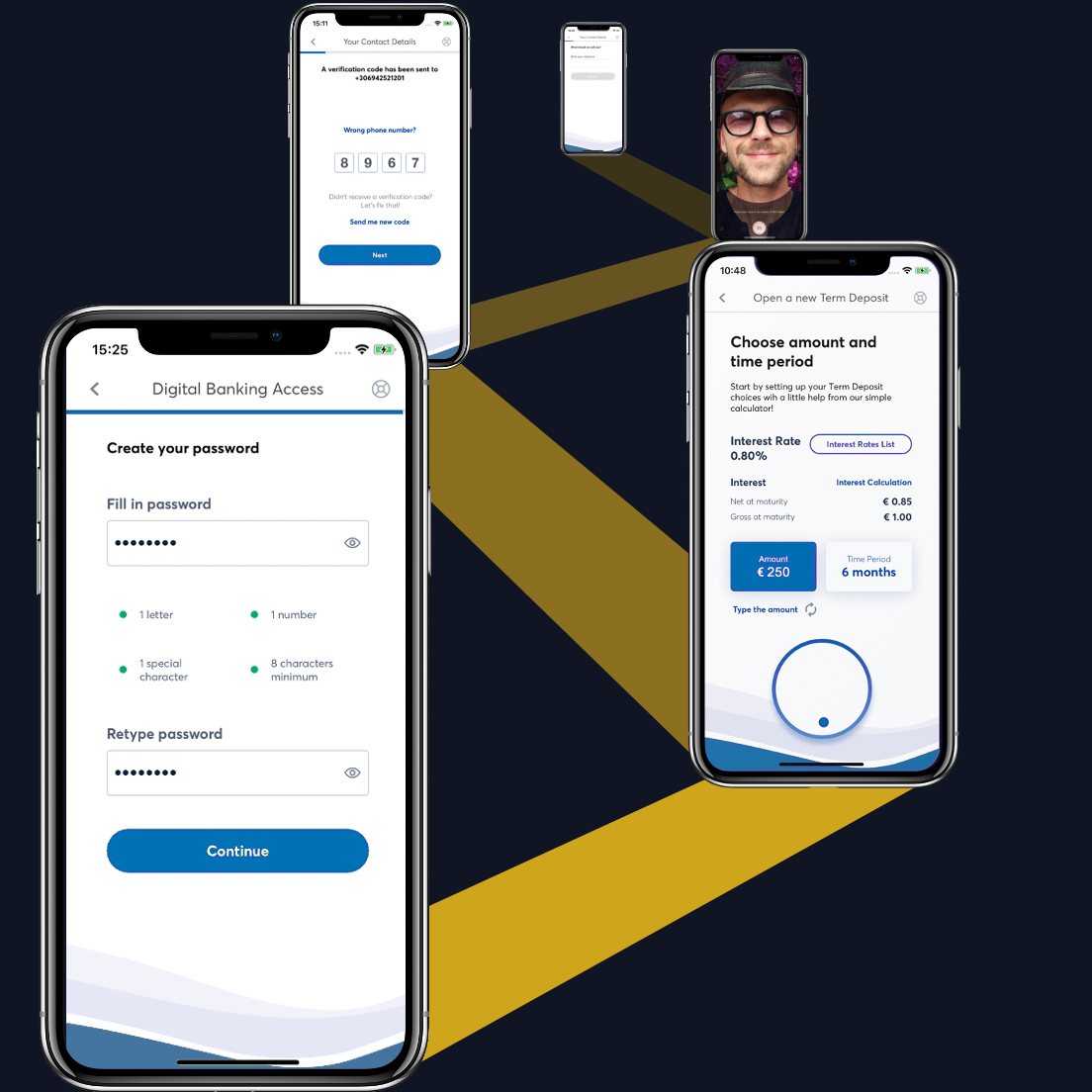

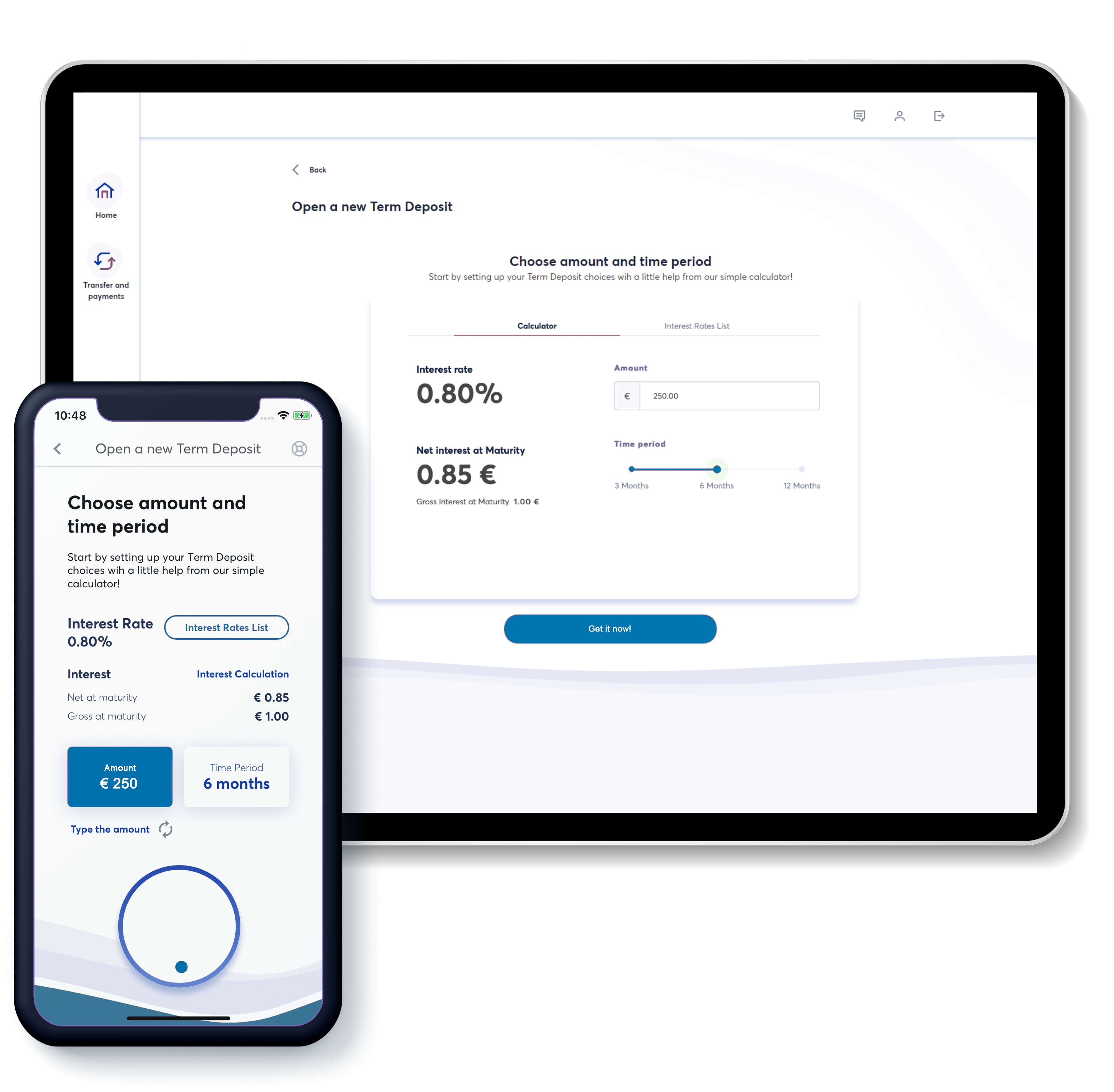

Truly native mobile apps

The mobile client apps for iOS and Android offer native experiences leveraging device capabilities (such as camera, location, file access, Google maps) and sophisticated banking components (such as product calculators, integrated ID verification SDKs, or video calls).

Product personalisation

Enable customers to customize your offerings according to their needs, with built in product calculators.

Truly native mobile apps

The mobile client apps for iOS and Android offer native experiences leveraging device capabilities (such as camera, location, file access, Google maps) and sophisticated banking components (such as product calculators, integrated ID verification SDKs, or video calls).

Product personalisation

Enable customers to customize your offerings according to their needs, with built in product calculators.

Create your own customer journeys

Build new screens on your own

- Design applications forms by dragging & dropping components onto a canvas.

- Configure the look and feel of each form, validations and business rules.

- Build forms once and distribute across channels and devices – native iOS, Android & Browser

- Access a rich toolbox of:

- Form components such as text, numeric, selectors, buttons, and more

- Banking components such as account selectors and calculators.

- Experience components such as avatars, or address locators on a map

Build new screens on your own

- Design applications forms by dragging & dropping components onto a canvas.

- Configure the look and feel of each form, validations and business rules.

- Build forms once and distribute across channels and devices – native iOS, Android & Browser

- Access a rich toolbox of:

- Form components such as text, numeric, selectors, buttons, and more

- Banking components such as account selectors and calculators.

- Experience components such as avatars, or address locators on a map.

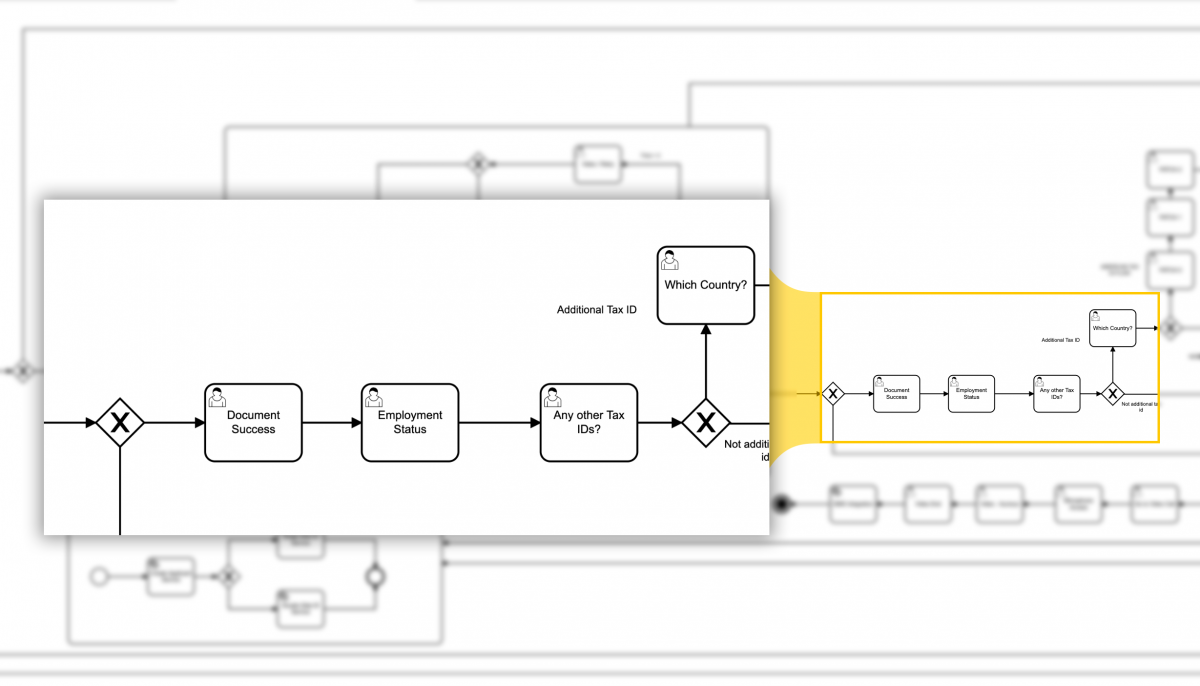

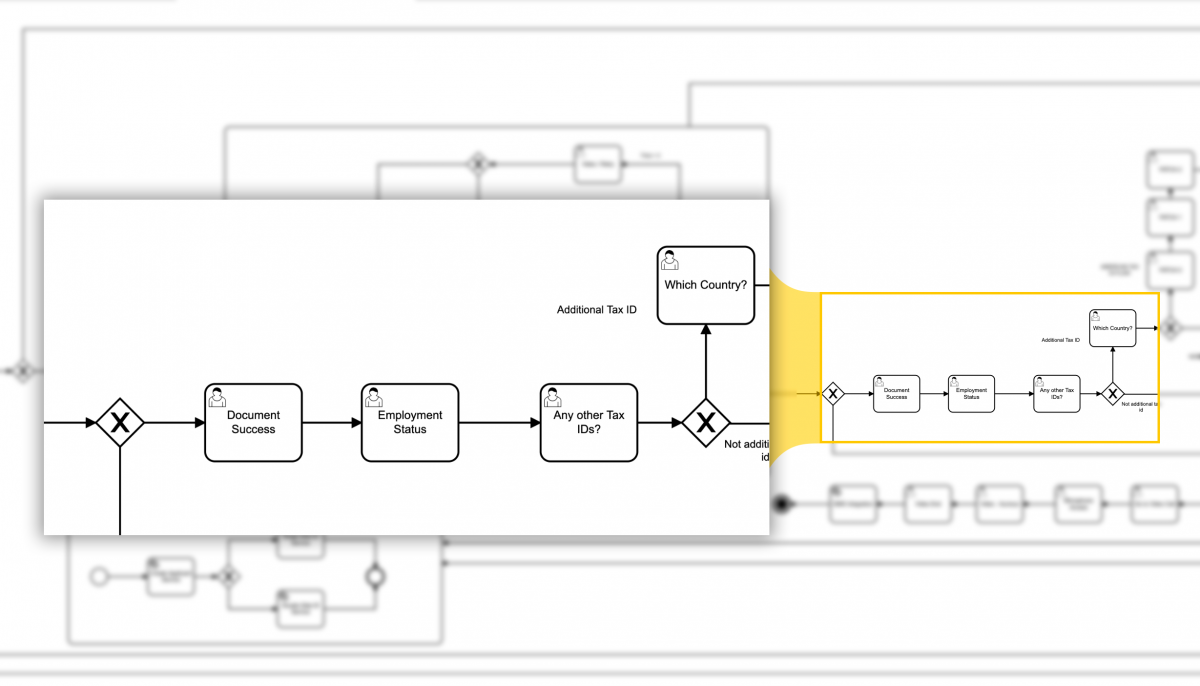

Build new customer journeys on your own

Design and deploy custom journeys. Make changes on the fly without the need to re-deploy across channels (web, mobile apps, branch).

- Leverage the built-in, standards-based tool (BPMN 2.0) to design workflow processes.

- Implement business logic.

- Take advantage of ready-to-use pre-configured steps, such as mobile number and email address verification

Build new customer journeys on your own

Design and deploy custom journeys. Make changes on the fly without the need to re-deploy across channels (web, mobile apps, branch).

- Leverage the built-in, standards-based tool (BPMN 2.0) to design workflow processes.

- Implement business logic.

- Take advantage of ready-to-use pre-configured steps, such as mobile number and email address verification

Accelerate, launch and monitor in real-time

Discover how your team can launch new journeys, configure products, and monitor applications.

Using Journey Analytics, business teams get an overall view of journey conversion and performance, and can drill into each step of the journey to discover friction points and drop-outs. Business teams can use these findings to continuously improve their customer journeys. Typical metrics include:

- Conversion rate.

- Friction indicator.

- Journey duration per step.

Track journeys in real time, and in detail.

The built-in Journey Monitor lets bank staff monitor and support customers throughout their journey.

See applications of customers who want to come onboard or acquire new products. Access all data provided by customers, including uploaded documents and photographs, in real-time. Track the progress of each application and assist customers in completing any missing steps.

Accelerate the development of your own journeys building on-top of production-ready journey templates, including:

Self-onboarding & origination

- Open a Term Deposit and optional insurance.

- Open a Current or Savings Account with optional insurance coverage and a Debit Card.

Branch onboarding & origination

Enhance and configure core product definitions to be marketed and delivered as a digital product variant without having to implement them in the underlying core system.

The Product Factory lets you fine-tune originating products and customize product attributes based on the customer audience that onboards.

Accelerate, launch and monitor in real-time

Discover how your team can launch new journeys, configure products, and monitor applications.

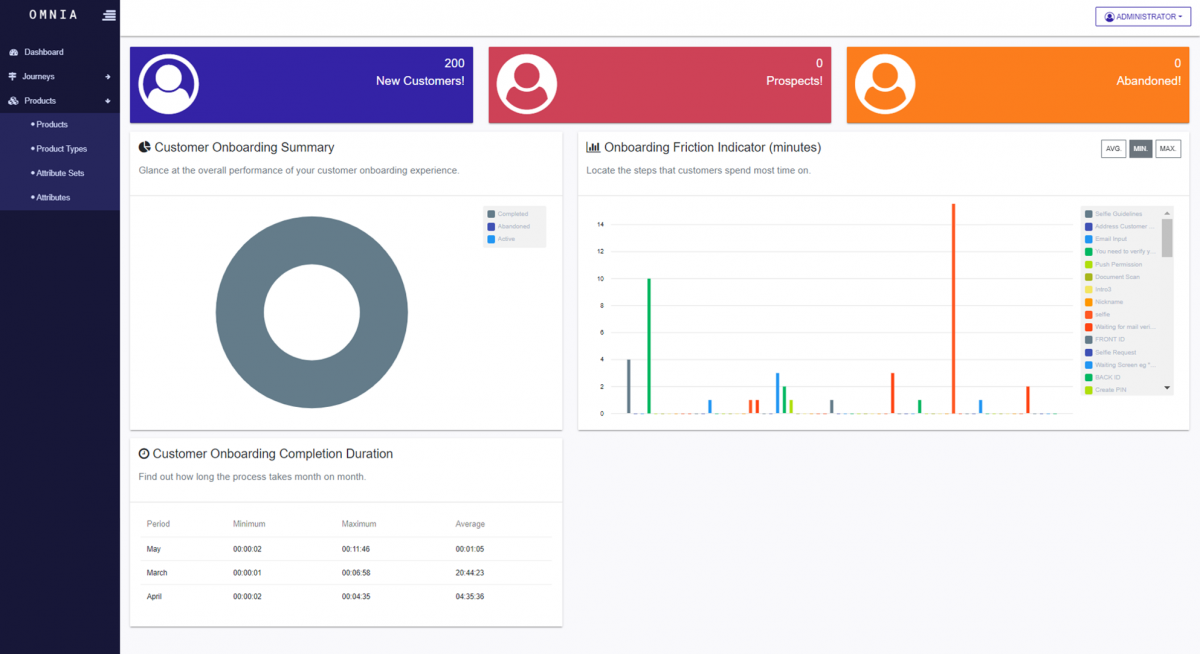

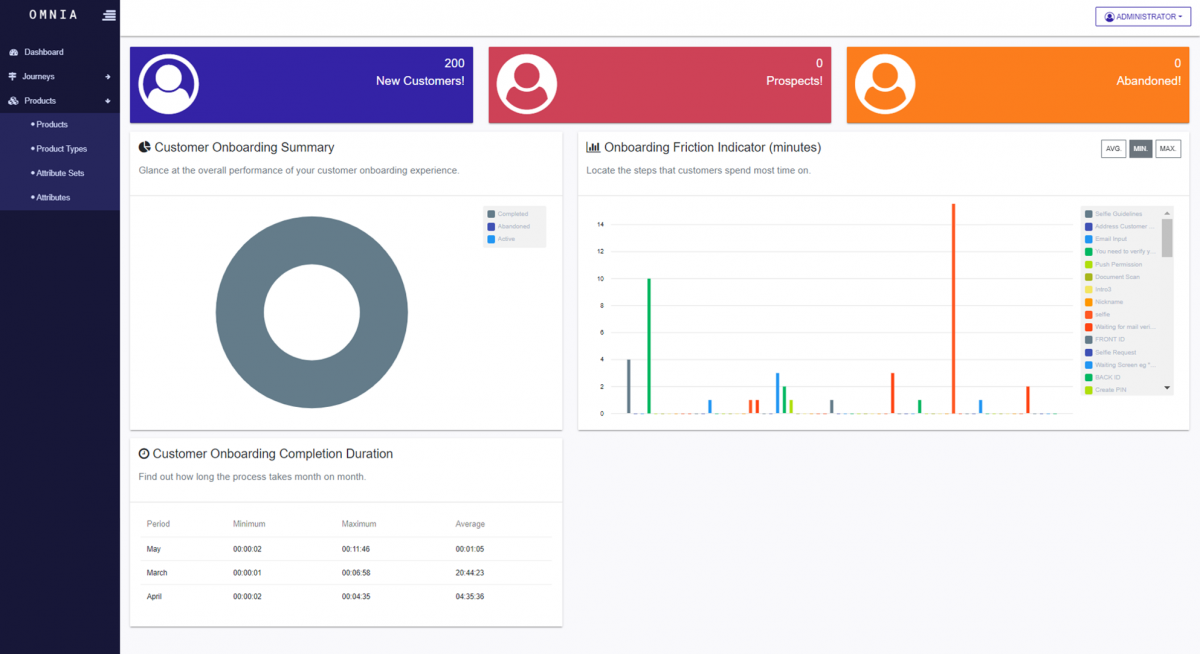

Aggregated Analytics

Using Journey Analytics, business teams get an overall view of journey conversion and performance, and can drill into each step of the journey to discover friction points and drop-outs. Business teams can use these findings to continuously improve their customer journeys. Typical metrics include:

- Conversion rate.

- Friction indicator.

- Journey duration per step.

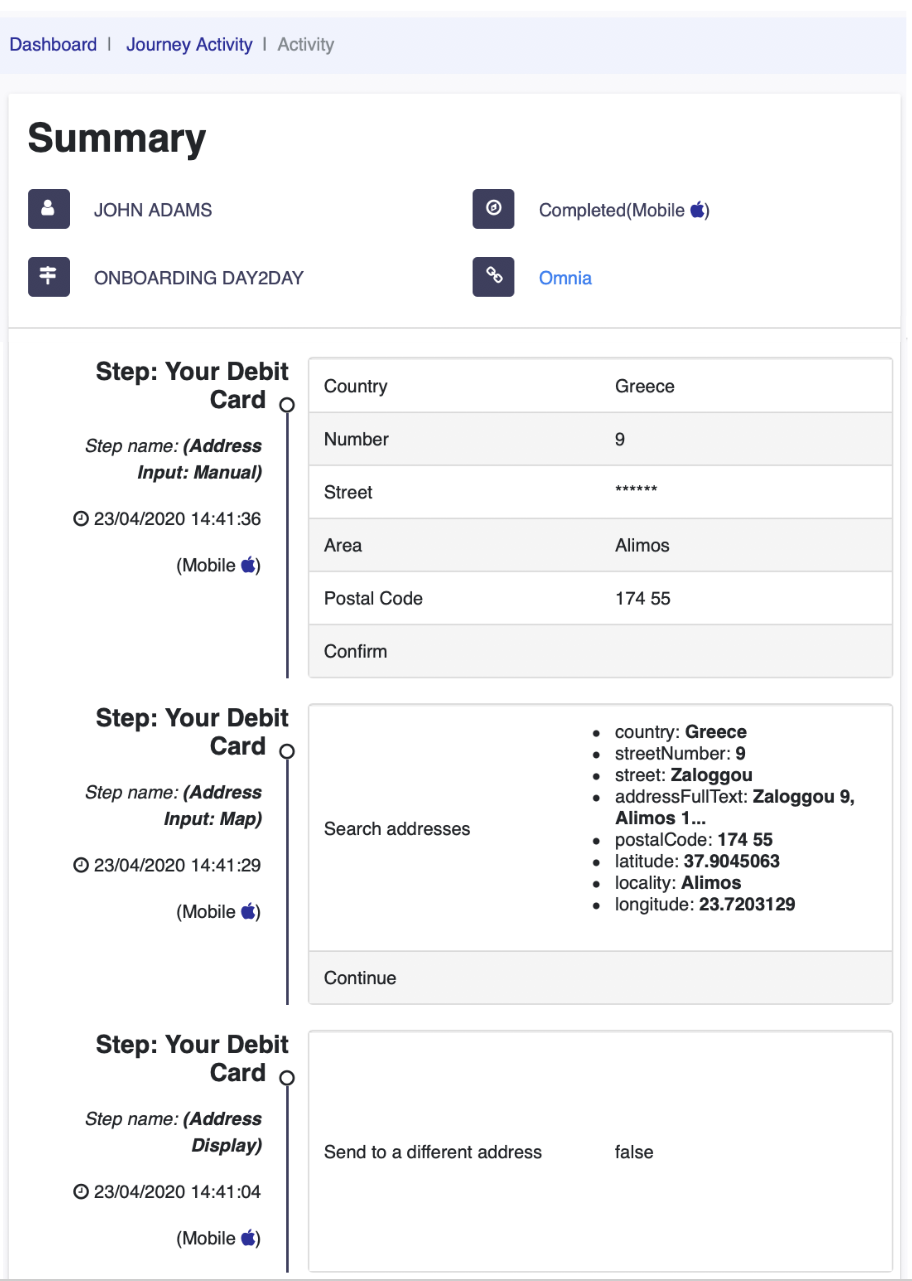

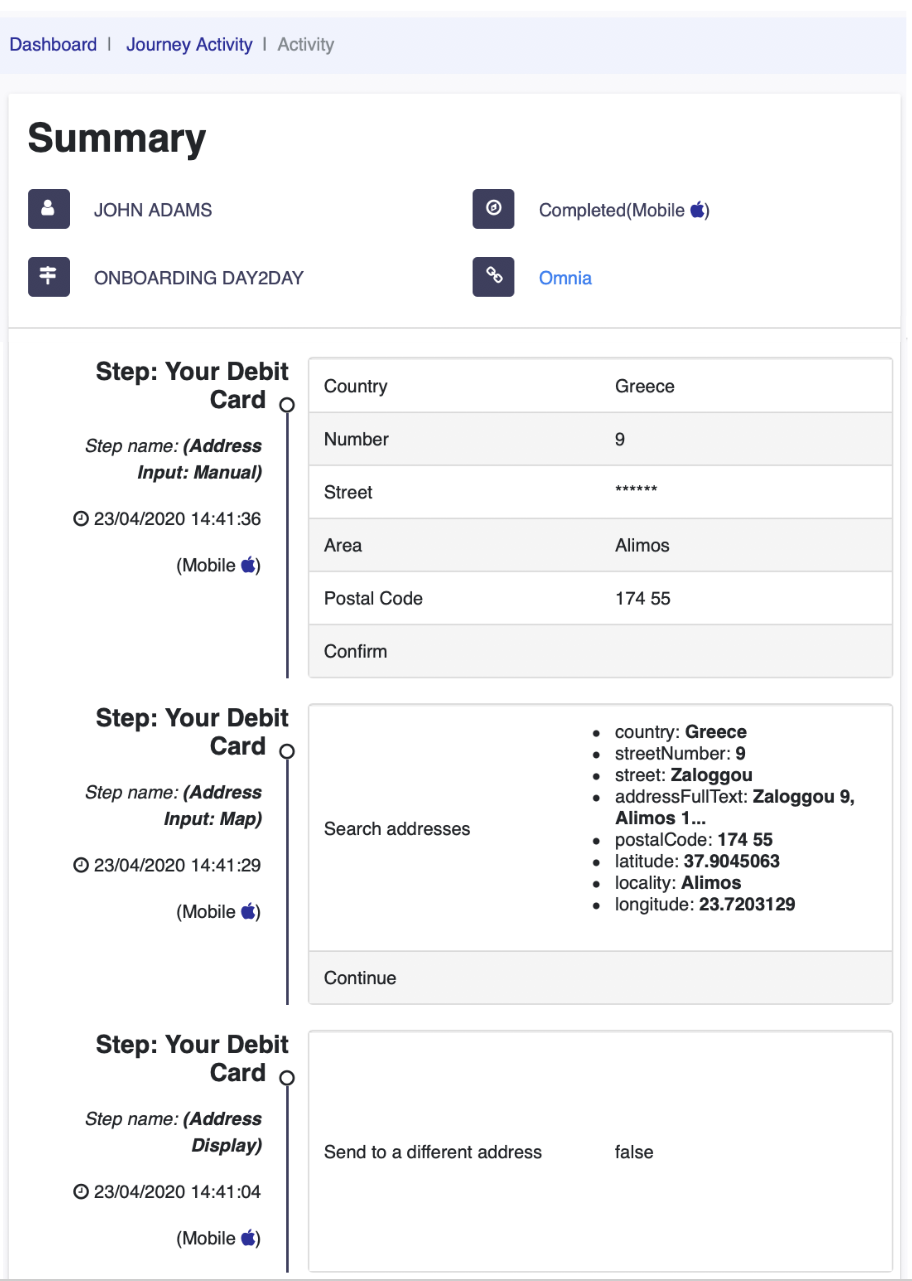

Journey Monitor

Track journeys in real time, and in detail.

The built-in Journey Monitor lets bank staff monitor and support customers throughout their journey.

See applications of customers who want to come onboard or acquire new products. Access all data provided by customers, including uploaded documents and photographs, in real-time. Track the progress of each application and assist customers in completing any missing steps.

Journey Templates

Accelerate the development of your own journeys building on-top of production-ready journey templates, including:

Self-onboarding & origination

- Open a Term Deposit and optional insurance.

- Open a Current or Savings Account with optional insurance coverage and a Debit Card.

Branch onboarding & origination

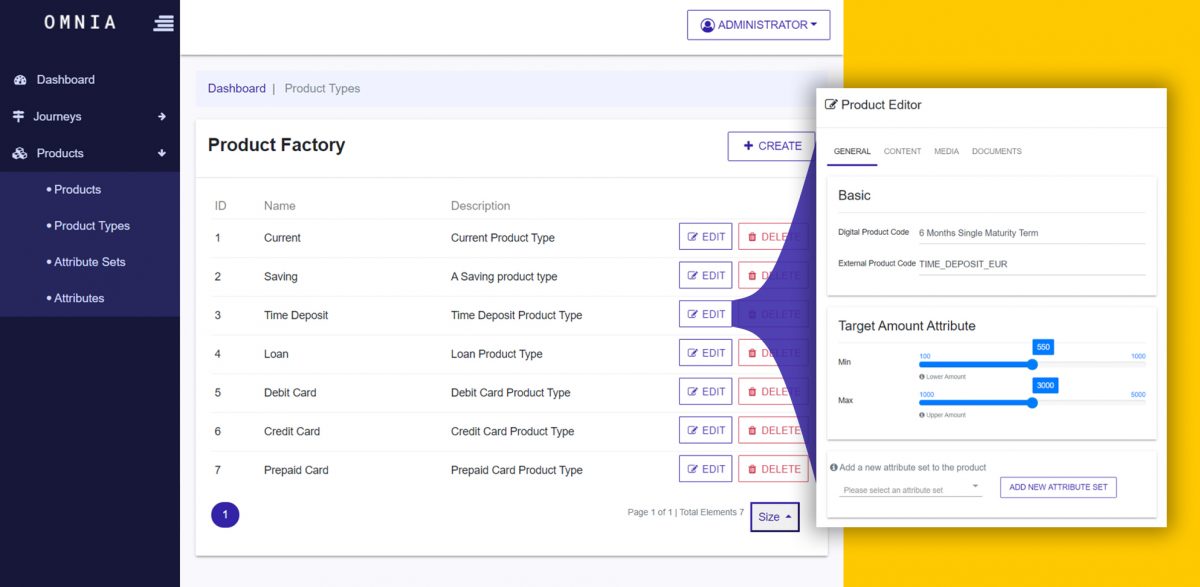

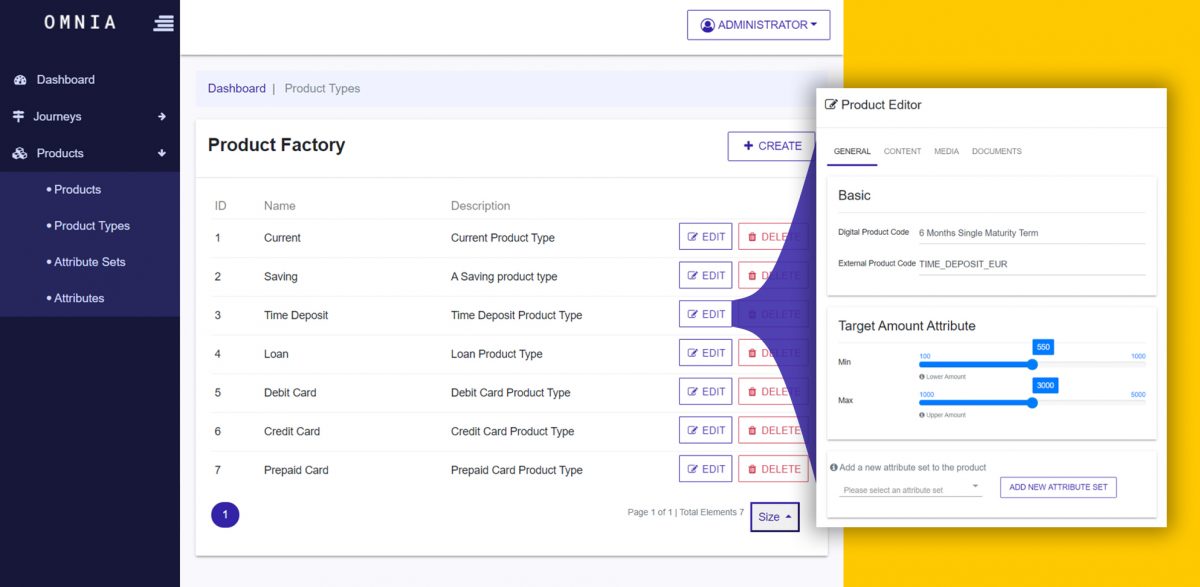

Product Factory

Enhance and configure core product definitions to be marketed and delivered as a digital product variant without having to implement them in the underlying core system.

The Product Factory lets you fine-tune originating products and customize product attributes based on the customer audience that onboards.