Omnia has the tools your business customers need to transact in a fast-changing world.

SOLUTIONS

Business Banking

From small companies

to large enterprises

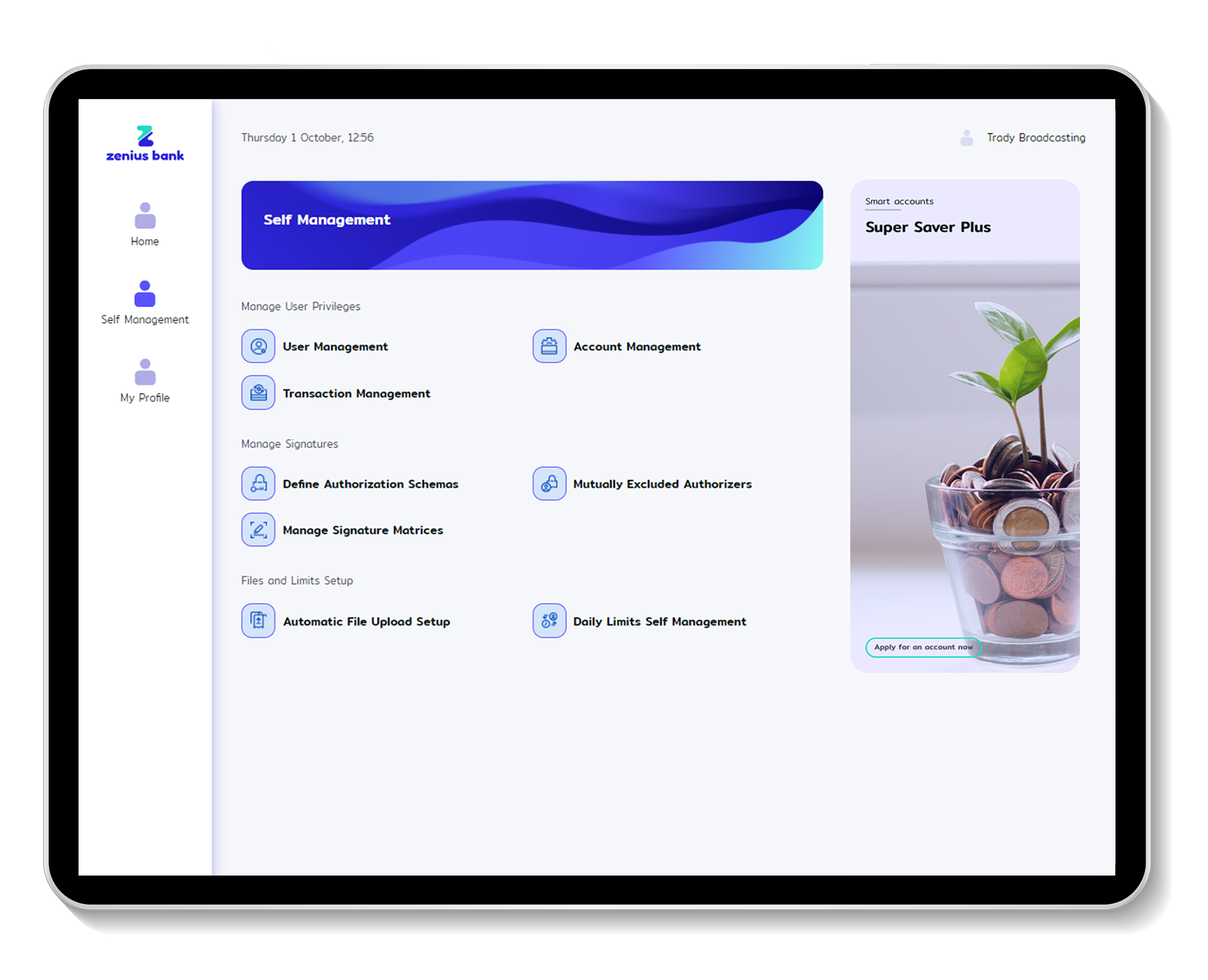

Entitlements management

Flexible authorization schemas

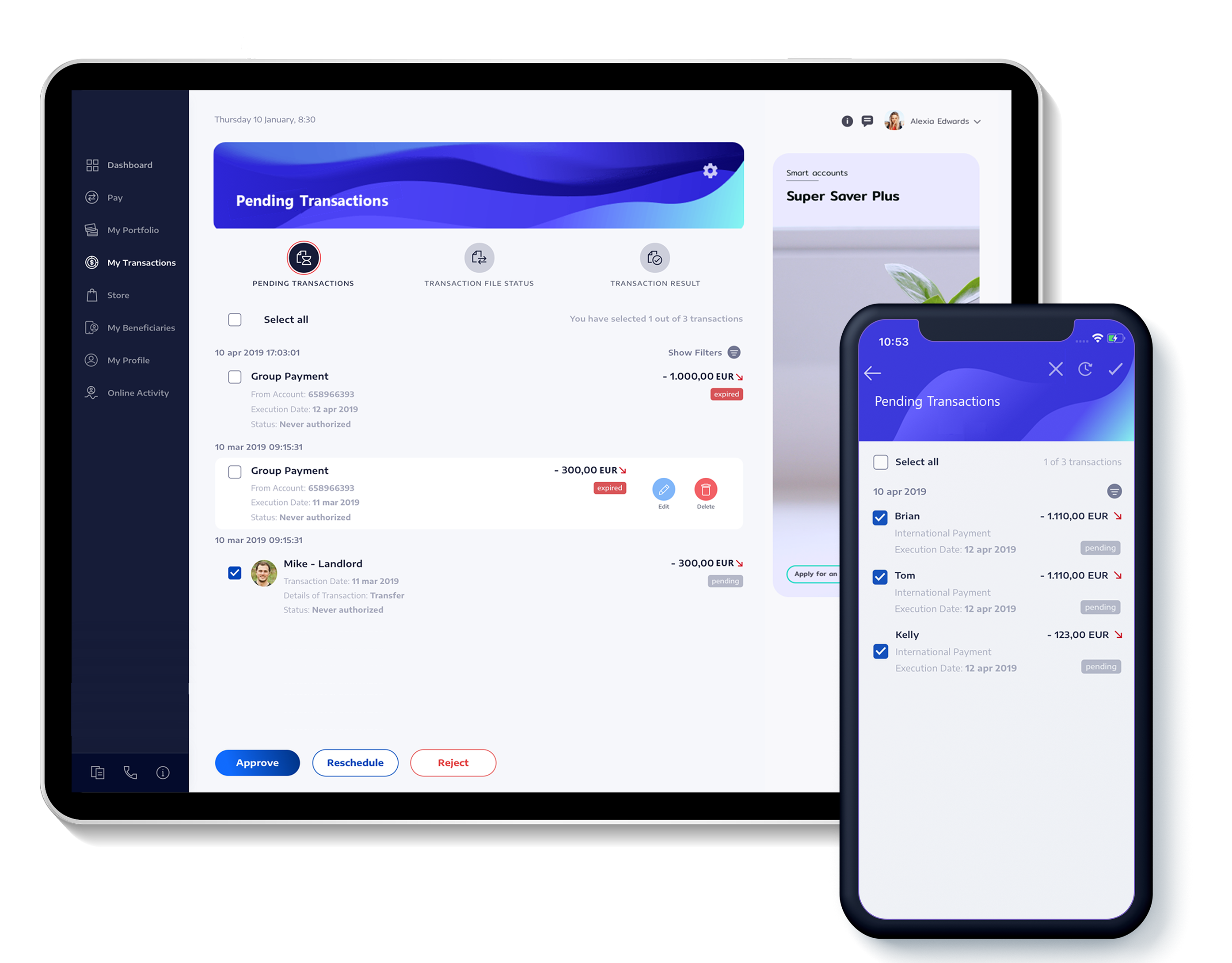

Business customers can setup their own transaction authorization schemas, as well as setup multiple levels of required signatories per transaction type, per account, or per amount.

Authorizers are automatically alerted and can approve multiple transactions at once.

User management & access rights

Business customers can self-manage their users and apply business rules that control account access privileges per user, available transactions, account rights and amount limits.

On top of that, bank employees can help business customers setup their e-banking profile, as well as their users and entitlements.

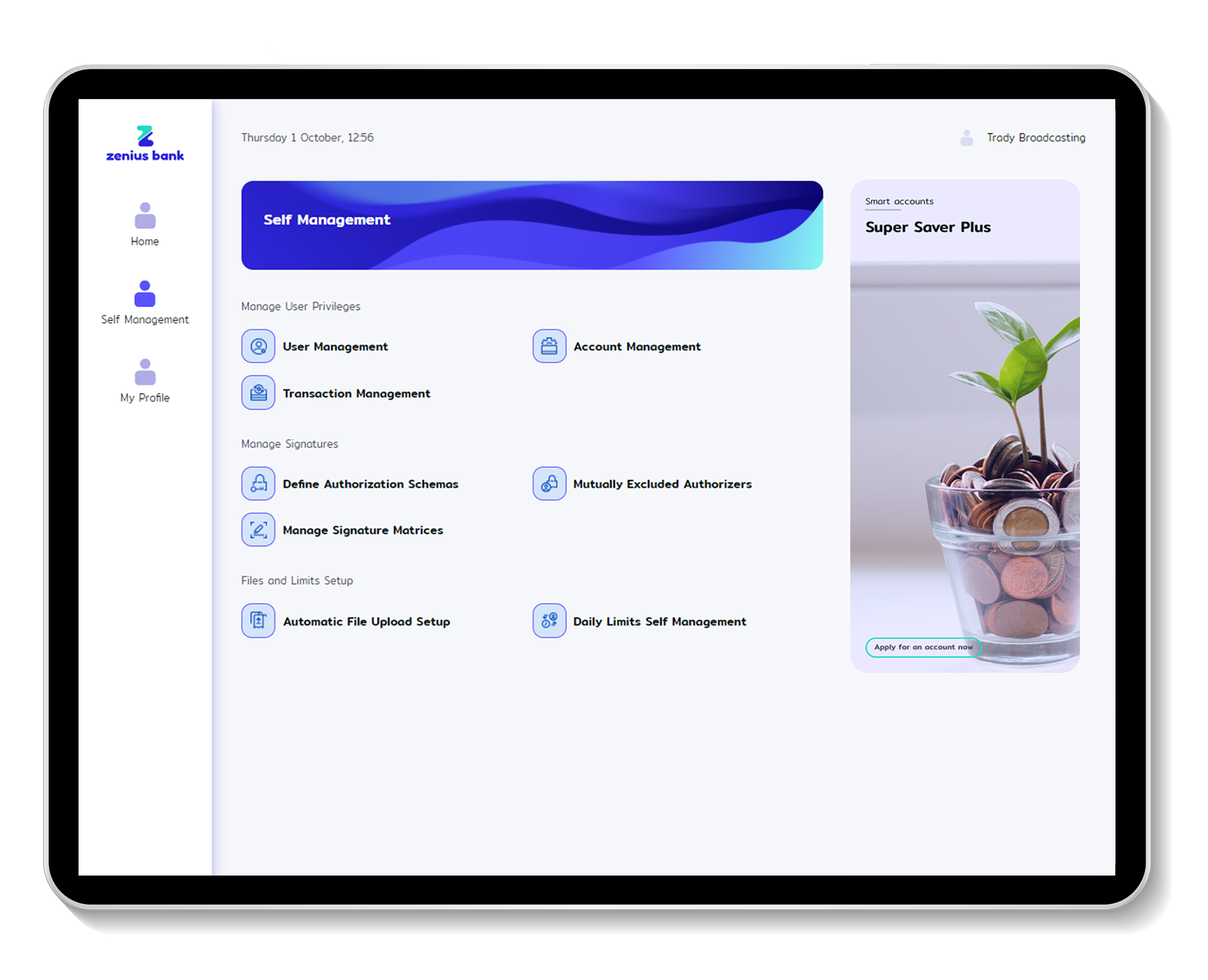

Entitlements management

Flexible authorization schemas

Business customers can setup their own transaction authorization schemas, as well as setup multiple levels of required signatories per transaction type, per account, or per amount.

Authorizers are automatically alerted and can approve multiple transactions at once.

User management & access rights

Business customers can self-manage their users and apply business rules that control account access privileges per user, available transactions, account rights and amount limits.

On top of that, bank employees can help business customers setup their e-banking profile, as well as their users and entitlements.

Batch payments

Beneficiaries management

Create multiple beneficiaries, either online or through file upload. Personalization, user-defined beneficiary groups, and access restrictions make it easy to locate and transact with the right people.

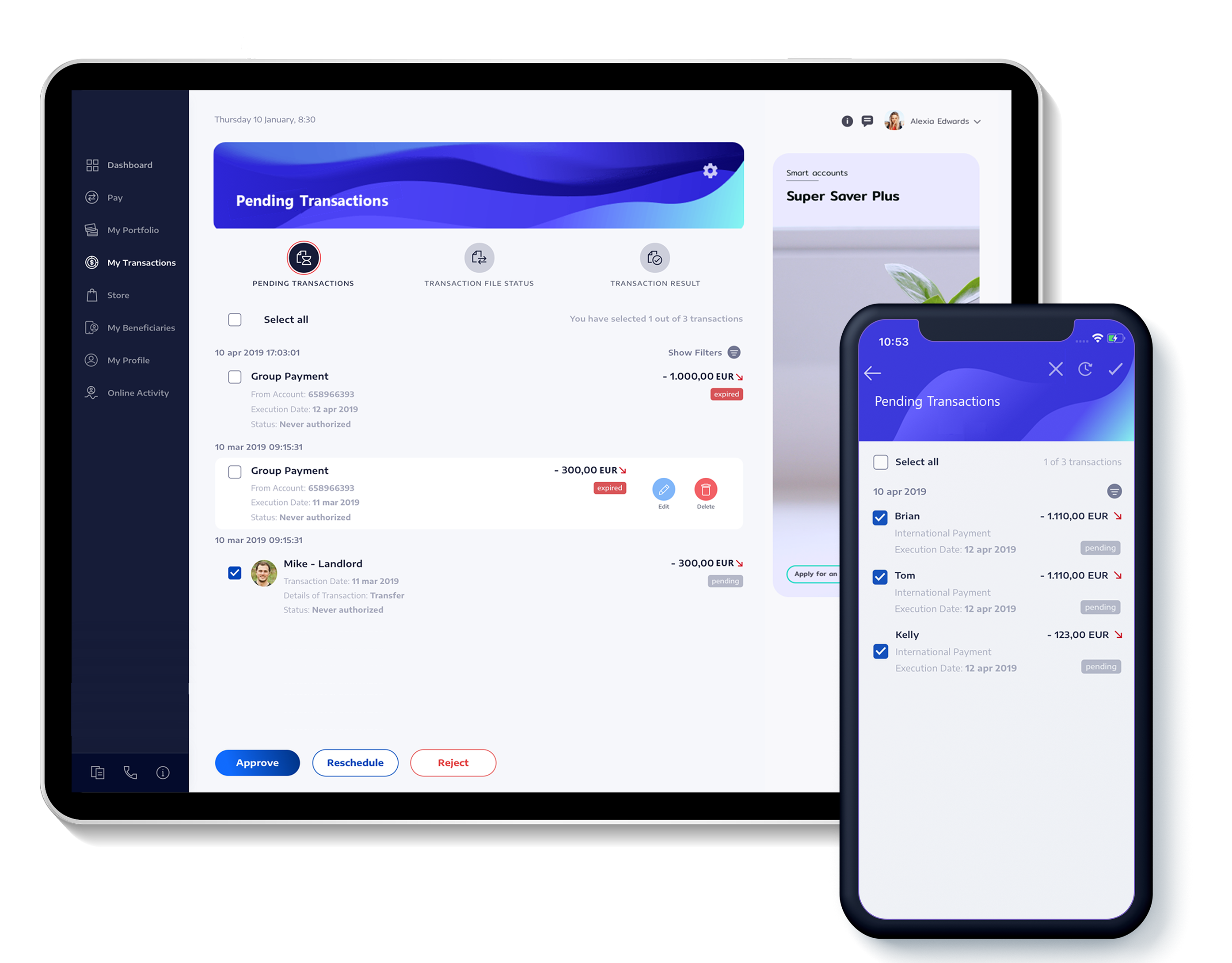

Group payments

Pay multiple beneficiaries in one move. Initiate multiple transactions to a group of beneficiaries, and apply the same amounts and descriptions to all payments or differentiate per beneficiary.

Mass payments (file upload)

Conduct one-to-one or one-to-many mass payments, via file upload, supporting all transaction types (own, domestic, international) and custom file formats.

Time consuming tasks (the file upload and validations), occur in the background, enabling users to carry on with their work.

Batch payments

Beneficiaries management

Create multiple beneficiaries, either online or through file upload. Personalization, user-defined beneficiary groups, and access restrictions make it easy to locate and transact with the right people.

Group payments

Pay multiple beneficiaries in one move. Initiate multiple transactions to a group of beneficiaries, and apply the same amounts and descriptions to all payments or differentiate per beneficiary.

Mass payments (file upload)

Conduct one-to-one or one-to-many mass payments, via file upload, supporting all transaction types (own, domestic, international) and custom file formats.

Time consuming tasks (the file upload and validations), occur in the background, enabling users to carry on with their work.

Streamlined information & auditing

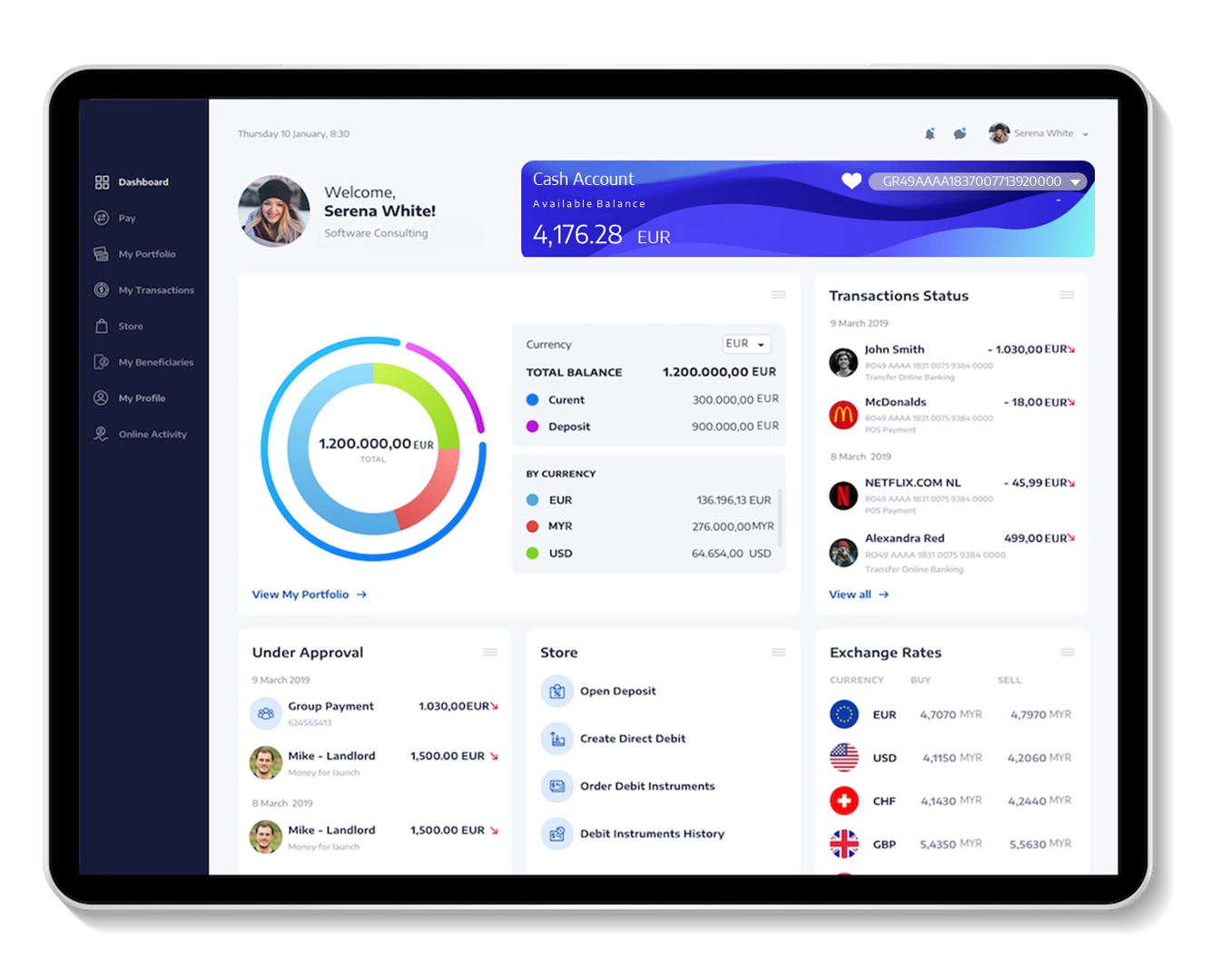

The Business Dashboard

Matching the structure of each business customer, the dashboard allows access to all company accounts each end-user is authorized to.

Account grouping and support for subsidiary accounts, enable business users to get a swift overview of their area of responsibility and quickly locate the task at hand.

On-line activity per user

Detailed logging of user activity, promotes transparency, letting business administrators to review the complete history of their end users’ actions.

Streamlined information & auditing

The Business Dashboard

Matching the structure of each business customer, the dashboard allows access to all company accounts each end-user is authorized to. Account grouping and support for subsidiary accounts, enable business users to get a swift overview of their area of responsibility and quickly locate the task at hand.

On-line activity per user

Detailed logging of user activity, promotes transparency, letting business administrators to review the complete history of their end users’ actions.

Get new business customers

Onboard businesses (remote and/or in-branch)

Facilitate the quick registration of new Business customers, either from their own premises or within your branches. Formulate engaging experiences that capture all required information, consent, & attestation material across channels (Web browser, Native mobile: iOS/Android).

Automate manual checks by bridging silos and enable more time for cross selling. Build your partnership with compelling digital experiences from the get-go.

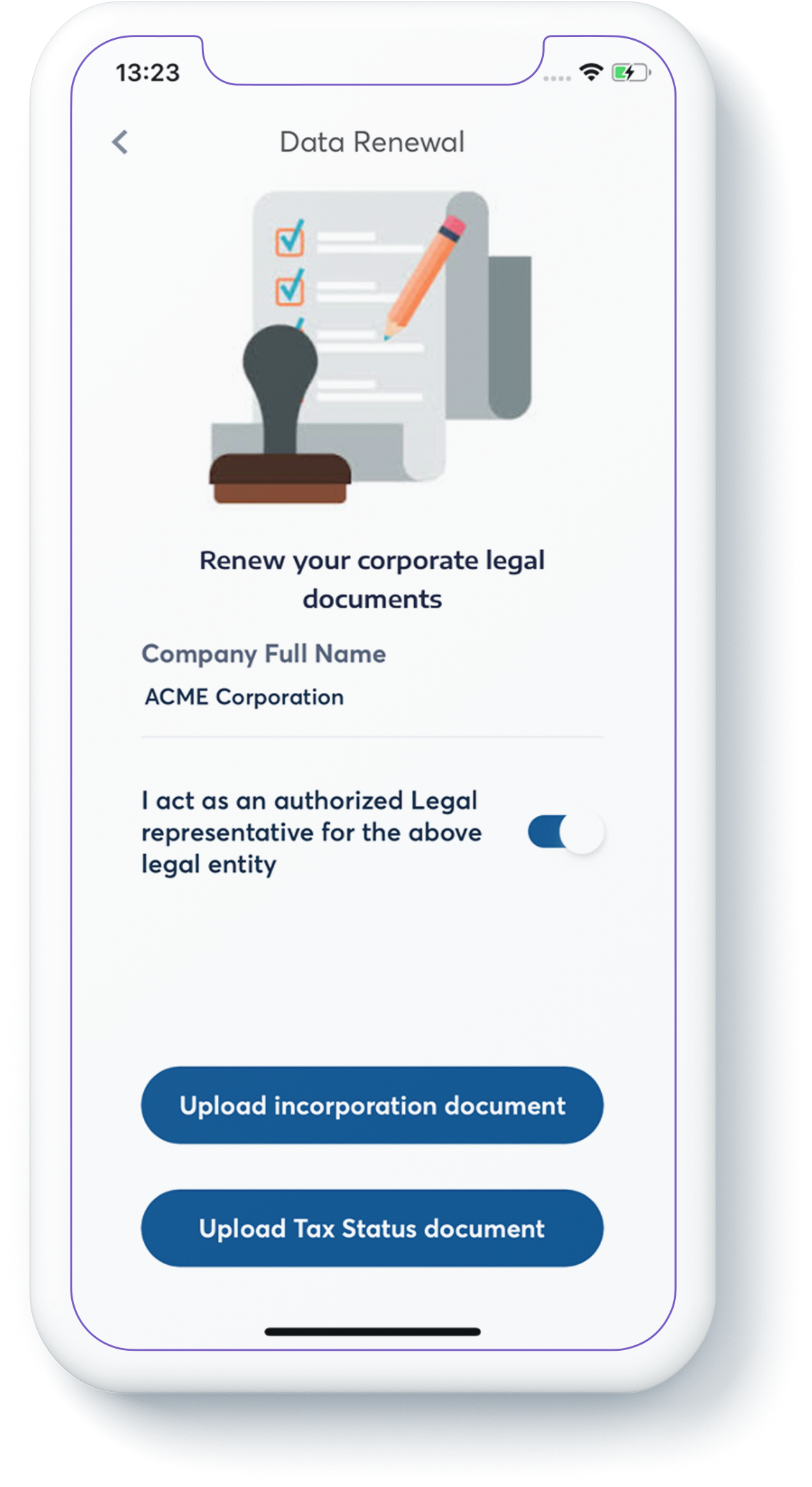

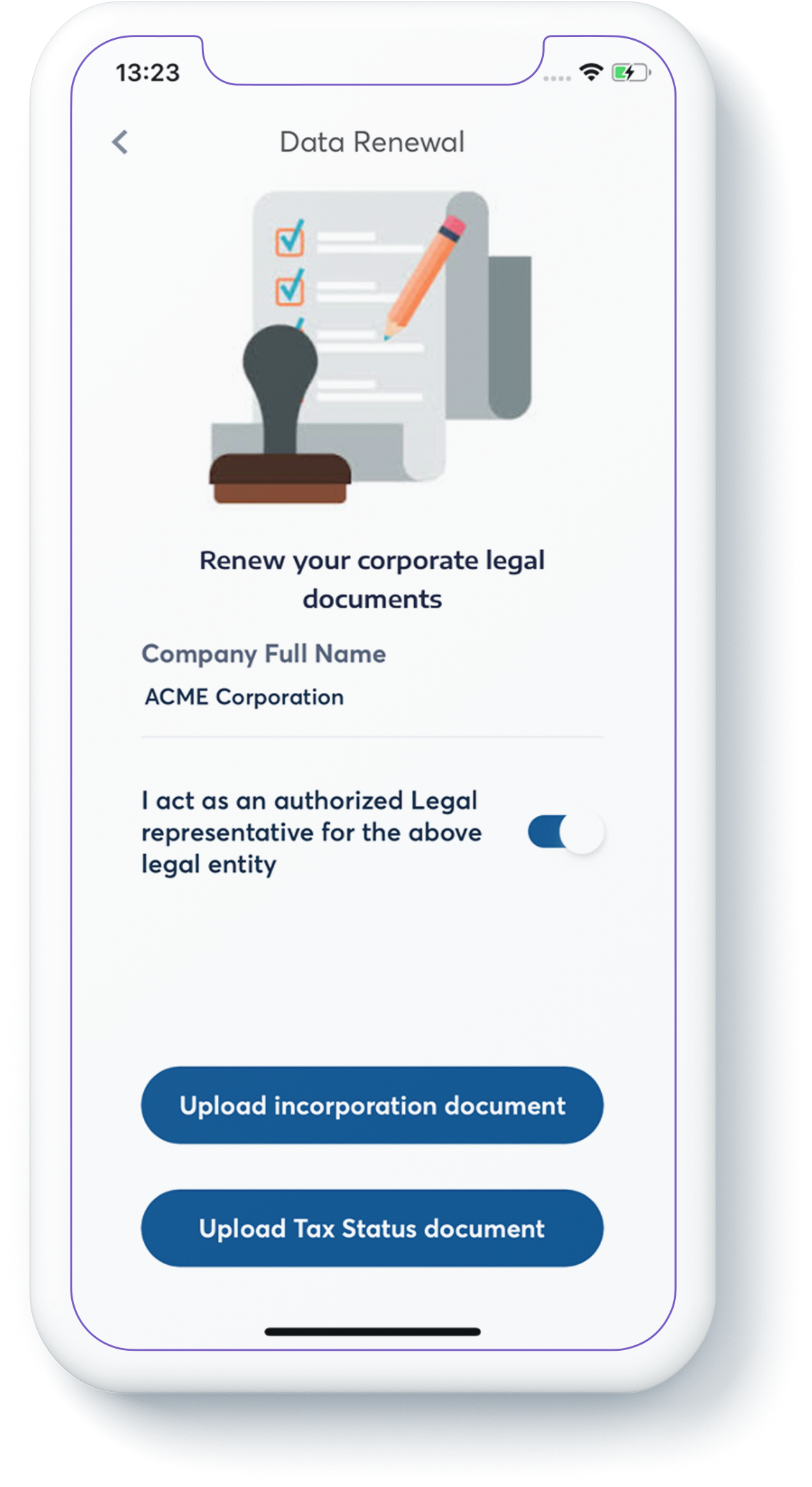

Update business data

Convert mandatory KYC updates to an intuitive online process that promotes new products & services.

Get new business customers

Onboard businesses (remote and/or in-branch)

Facilitate the quick registration of new Business customers, either from their own premises or within your branches. Formulate engaging experiences that capture all required information, consent, & attestation material across channels (Web browser, Native mobile: iOS/Android).

Automate manual checks by bridging silos and enable more time for cross selling. Build your partnership with compelling digital experiences from the get-go.

Update business data

Convert mandatory KYC updates to an intuitive online process that promotes new products & services.

Deliver the best UX to your customers

Fully Native Mobile Apps

Omnia delivers 100% native mobile apps for smartphones & tablets, for both iOS & Android. This allows you to benefit from the native platform capabilities and provides:

- Full support of Biometric Authentication (fingerprint, Face-id) for SCA, Quick Login and Transactions Authorization

- Actionable Push Notifications allowing for cross-channel transactions authorization with two taps.

- Optimized user experience incorporating native support for smooth transitions, swipe gestures, camera, contact list and GPS Access

Deliver the best UX to your customers

Fully Native Mobile Apps

Omnia delivers 100% native mobile apps for smartphones & tablets, for both iOS & Android. This allows you to benefit from the native platform capabilities and provides:

- Full support of Biometric Authentication (fingerprint, Face-id) for SCA, Quick Login and Transactions Authorization

- Actionable Push Notifications allowing for cross-channel transactions authorization with two taps.

- Optimized user experience incorporating native support for smooth transitions, swipe gestures, camera, contact list and GPS Access