Engaging digital experiences are part of our everyday life and banking should be no exception. Omnia comes packed with everything your retail users need to transact with your bank on the go.

SOLUTIONS

RETAIL BANKING

Simple and powerful everyday banking

Help customers manage their finances

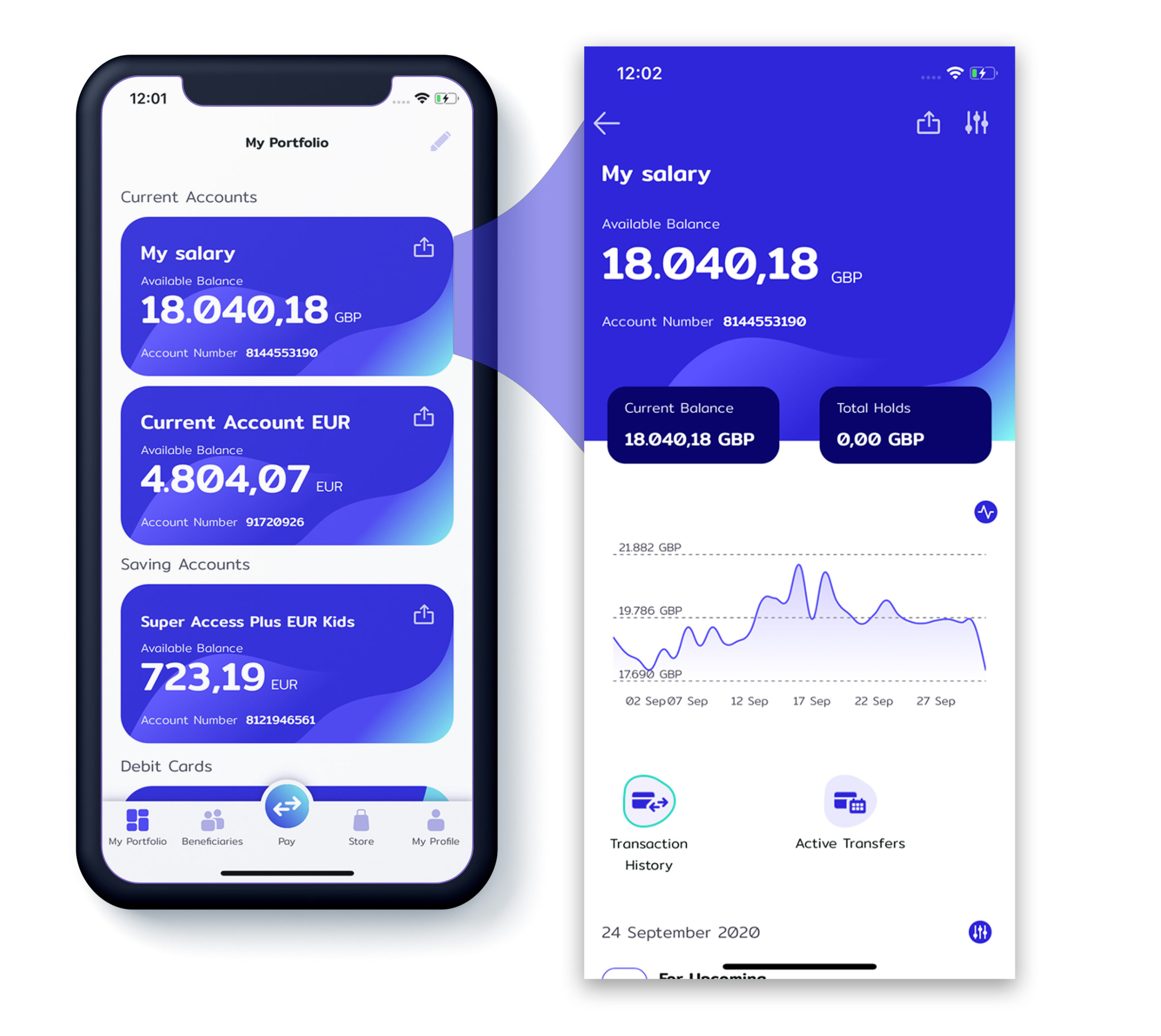

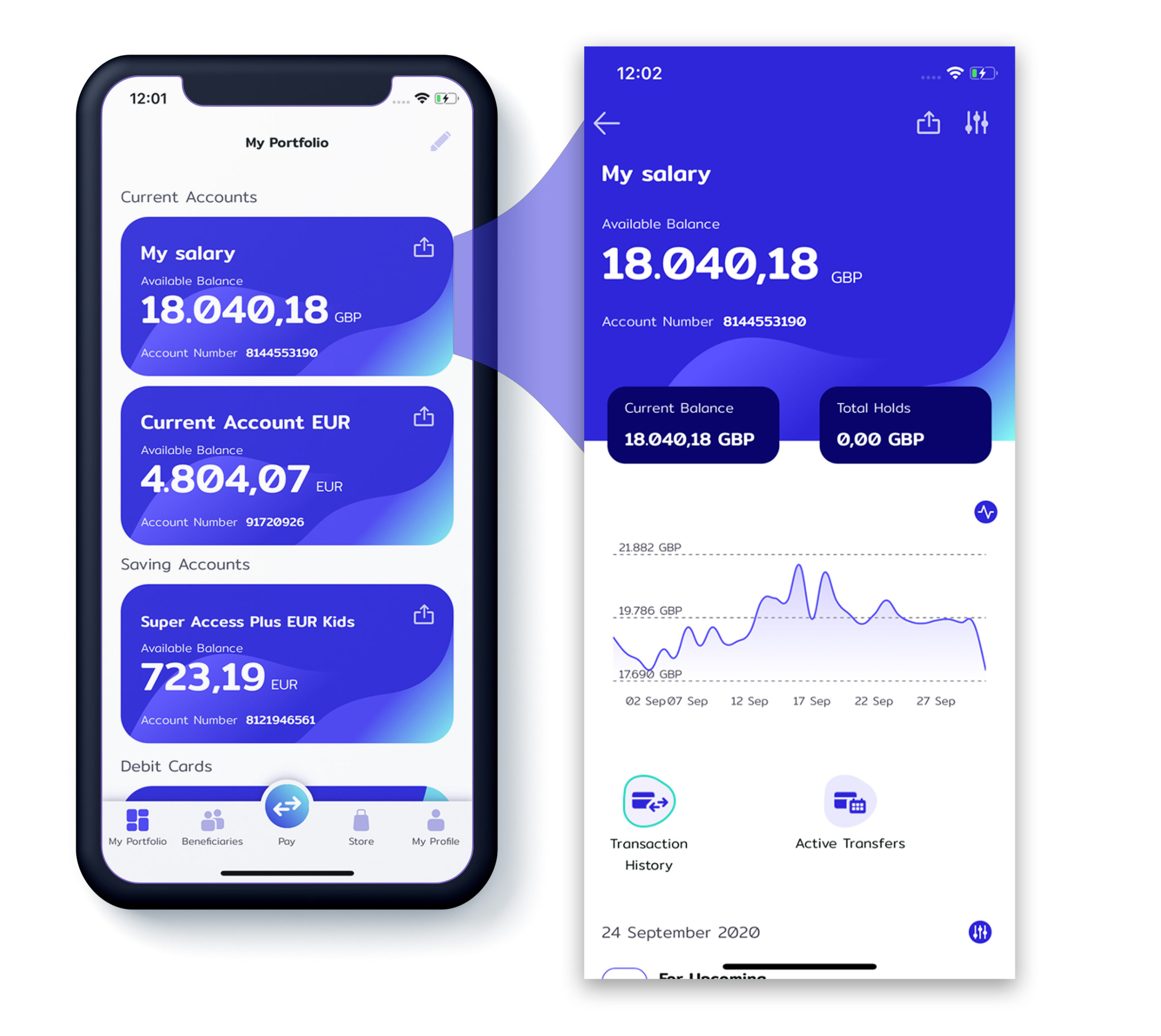

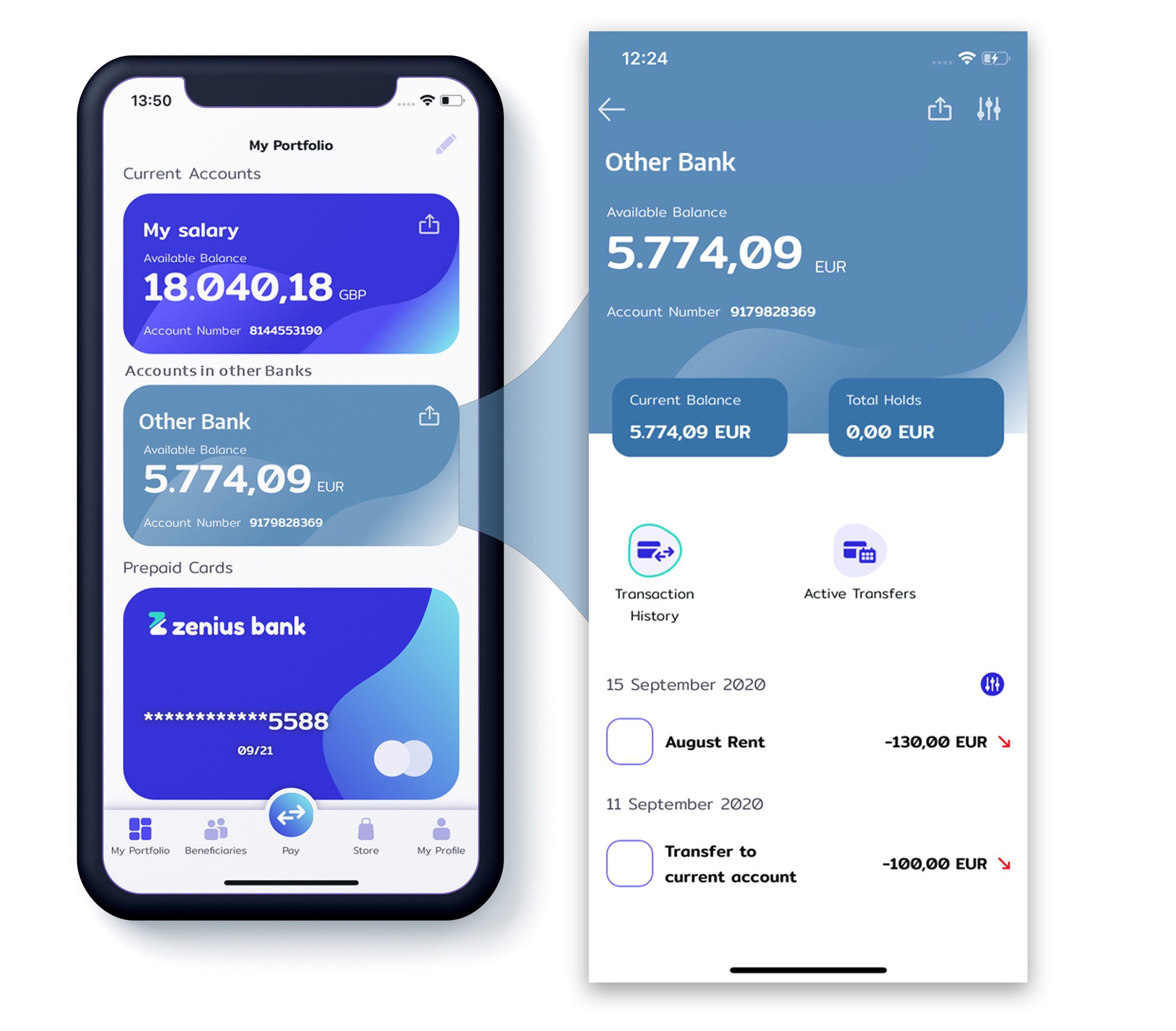

360° view of accounts

The dashboard acts as the main control center, where your customers see all eligible accounts and products.

Product origination

Customers can initiate transactions, purchase new products, and self-manage their beneficiaries and settings.

Personalized campaigns

Display personalized campaigns about new products or services to increase adoption.

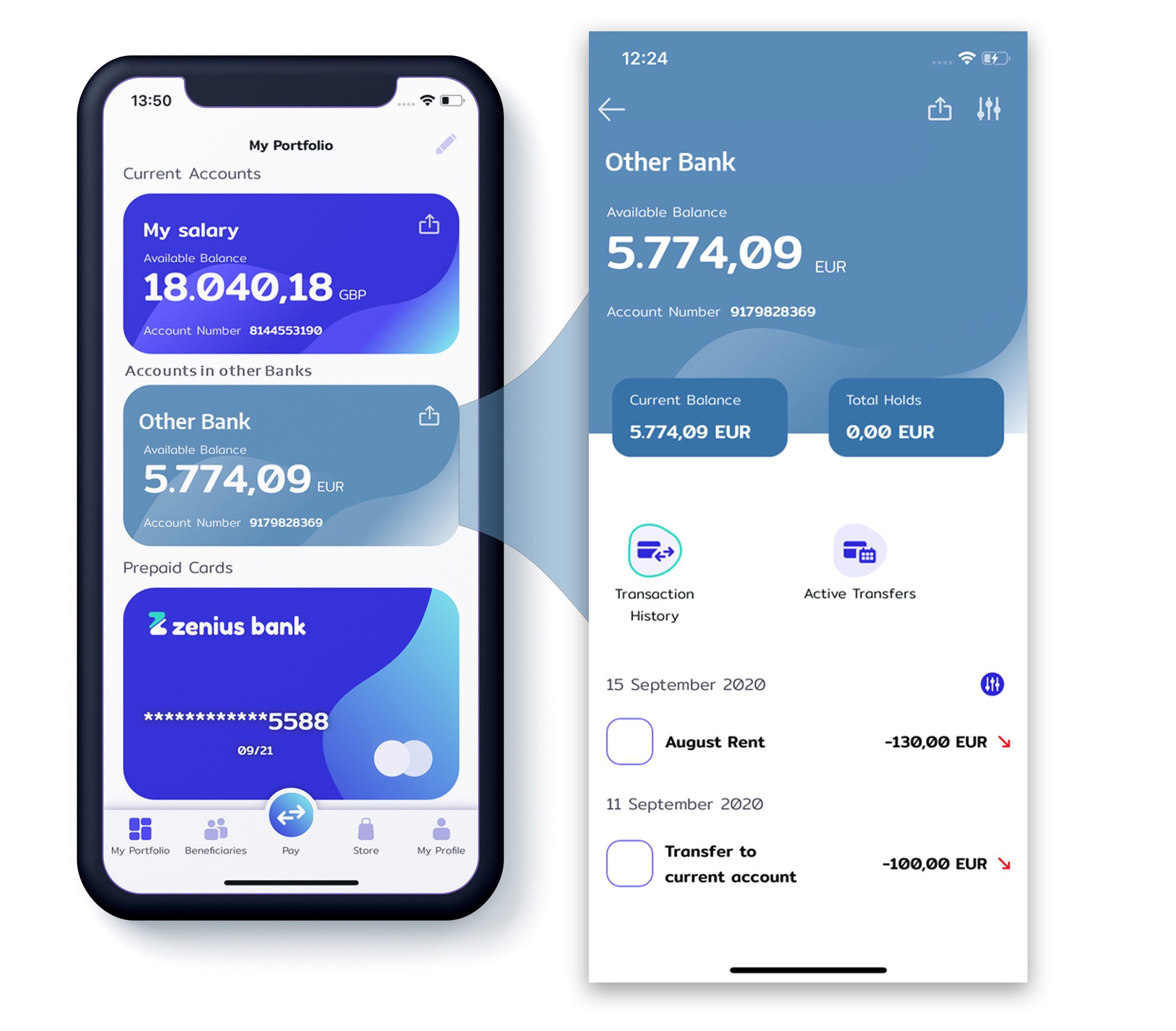

Display accounts held in other banks

Let customers monitor their finances across banks. Fetch details and transactions history from accounts your customers hold elsewhere. Powered by PSD2 / Open APIs.

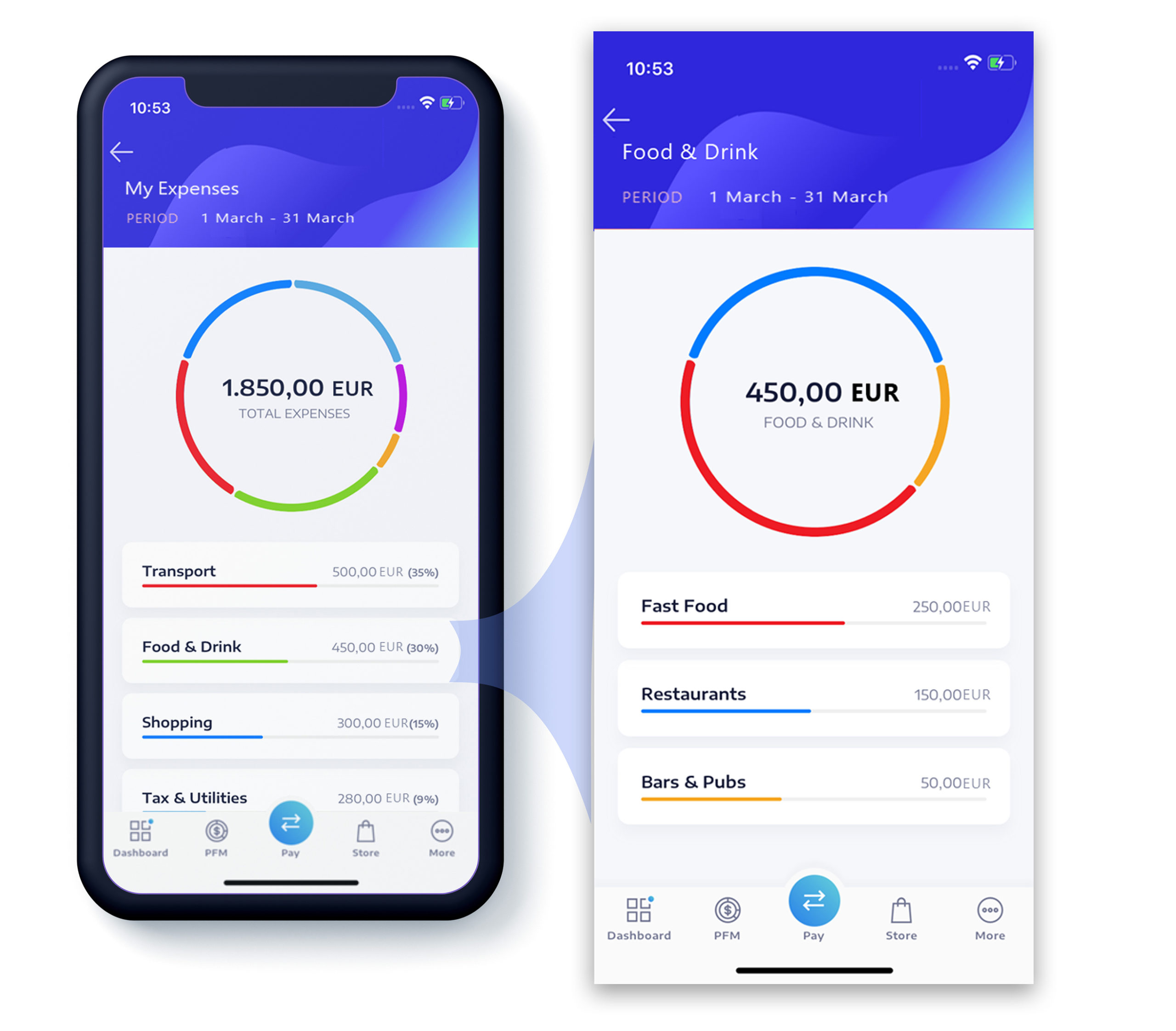

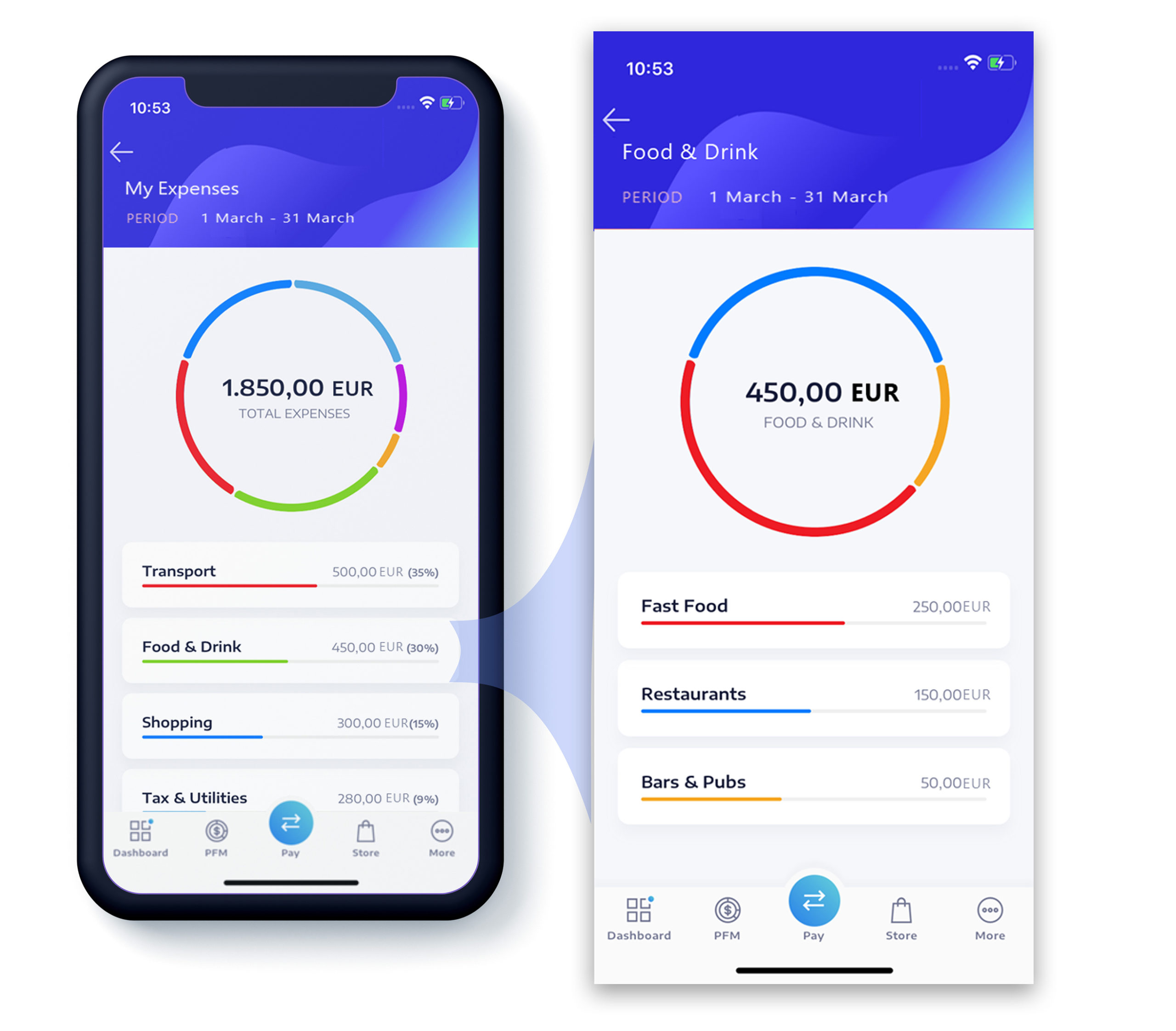

Help customers track how they spend their money

Omnia can present categorized transactions to your customers, making it easy for them to understand their spending habits.

Help customers manage their finances

Unified dashboard

360° view of accounts

The dashboard acts as the main control center, where your customers see all eligible accounts and products.

Product origination

Customers can initiate transactions, purchase new products, and self-manage their beneficiaries and settings.

Personalized campaigns

Display personalized campaigns about new products or services to increase adoption.

Account aggregation

Display accounts held in other banks

Let customers monitor their finances across banks. Fetch details and transactions history from accounts your customers hold elsewhere. Powered by PSD2 / Open APIs.

Expense categorization

Help customers track how they spend their money

Omnia can present categorized transactions to your customers, making it easy for them to understand their spending habits.

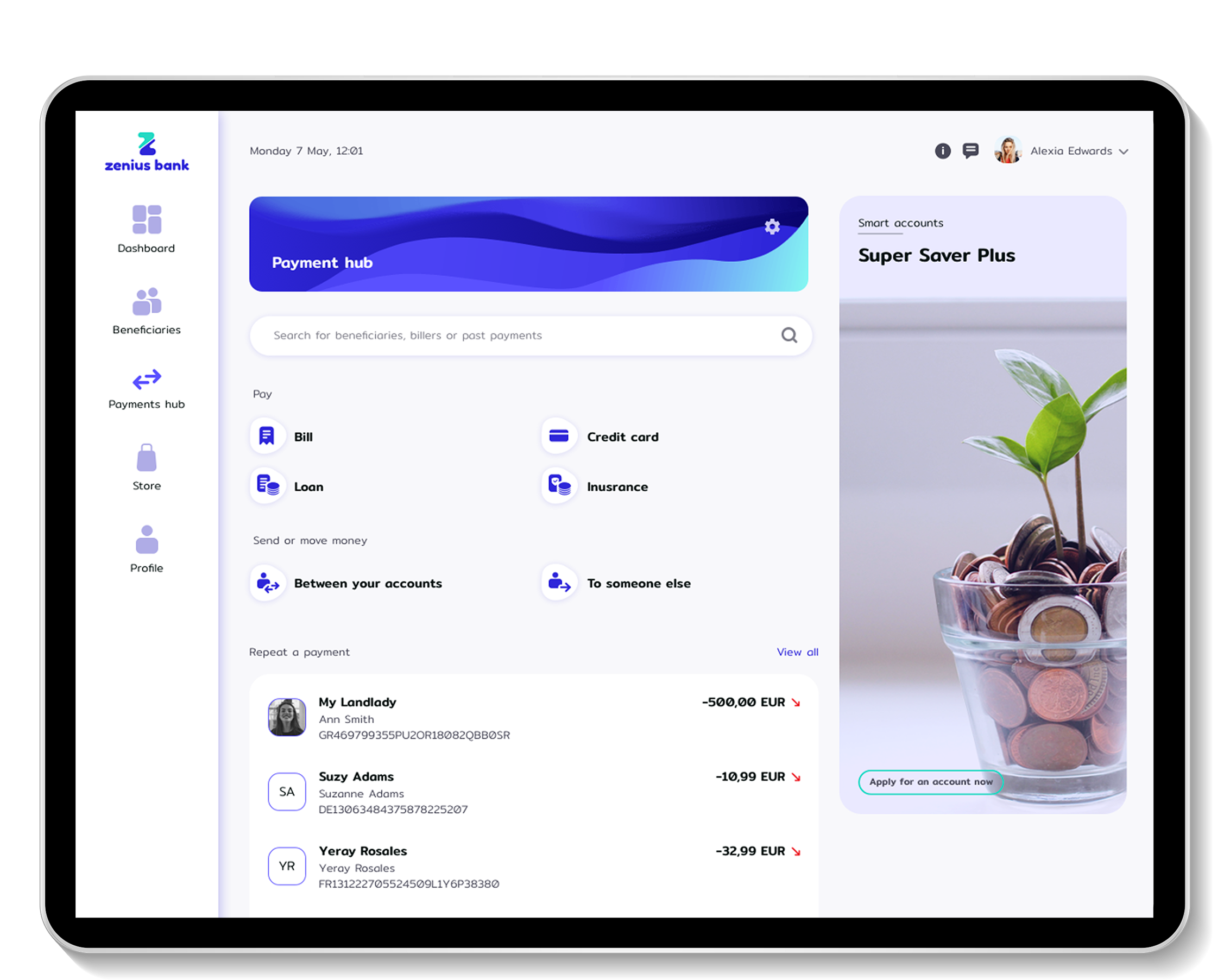

Simplify payments

Unified Payments Hub

Simplify user interaction by eliminating banking jargon (“domestic” or “international” payments). The customers just enter the biller or account they want to send money to and Omnia guides them through the process.

Smart Search

Customers can comfortably search for past transactions across beneficiaries, billers, dates, amounts and descriptions. Repeat a past transaction, pay a biller, or setup a recurring payment in a snap.

Beneficiaries / Payees, P2P payments

Manage your beneficiaries like you manage your phone contacts. Link each beneficiary with multiple bank accounts, email & phone number. Use either one to send money.

Simplify payments

Unified Payments Hub

Simplify user interaction by eliminating banking jargon (“domestic” or “international” payments). The customers just enter the biller or account they want to send money to and Omnia guides them through the process.

Smart Search

Customers can comfortably search for past transactions across beneficiaries, billers, dates, amounts and descriptions. Repeat a past transaction, pay a biller, or setup a recurring payment in a snap.

Beneficiaries / Payees, P2P payments

Manage your beneficiaries like you manage your phone contacts. Link each beneficiary with multiple bank accounts, email & phone number. Use either one to send money.

Onboard new customers. Activate dormant ones.

Onboard new customers from home or in-branch.

Formulate an intuitive step by step process to capture the required customer information & consent, as well as perform ID document verification and liveness detection or video calling across all channels (web, mobile via native apps, branch).

Update data for existing customers.

Update expired customer information online. Prompt dormant customers to verify their data and recommence business with your bank.

Onboard new customers. Activate dormant ones.

Onboard new customers from home or in-branch.

Formulate an intuitive step by step process to capture the required customer information & consent, as well as perform ID document verification and liveness detection or video calling across all channels (web, mobile via native apps, branch).

Update data for existing customers.

Update expired customer information online. Prompt dormant customers to verify their data and recommence business with your bank.

Promote offers and products

Campaigns Delivery

Define customer segments based on demographic, financial or other criteria. Create a digital campaign with rich content and configure the call-to-actions.

Deliver campaigns to targeted customers, across all channels and at the right moment.

Product Originations

Enable customers to apply for and get new bank accounts, time deposits, loans, credit cards or other product. Link originations to campaigns and get increased conversion rates.

Promote offers and products

Campaigns Delivery

Define customer segments based on demographic, financial or other criteria. Create a digital campaign with rich content and configure the call-to-actions.

Deliver campaigns to targeted customers, across all channels and at the right moment.

Product Originations

Enable customers to apply for and get new bank accounts, time deposits, loans, credit cards or other product. Link originations to campaigns and get increased conversion rates.

Cater for customer self-service

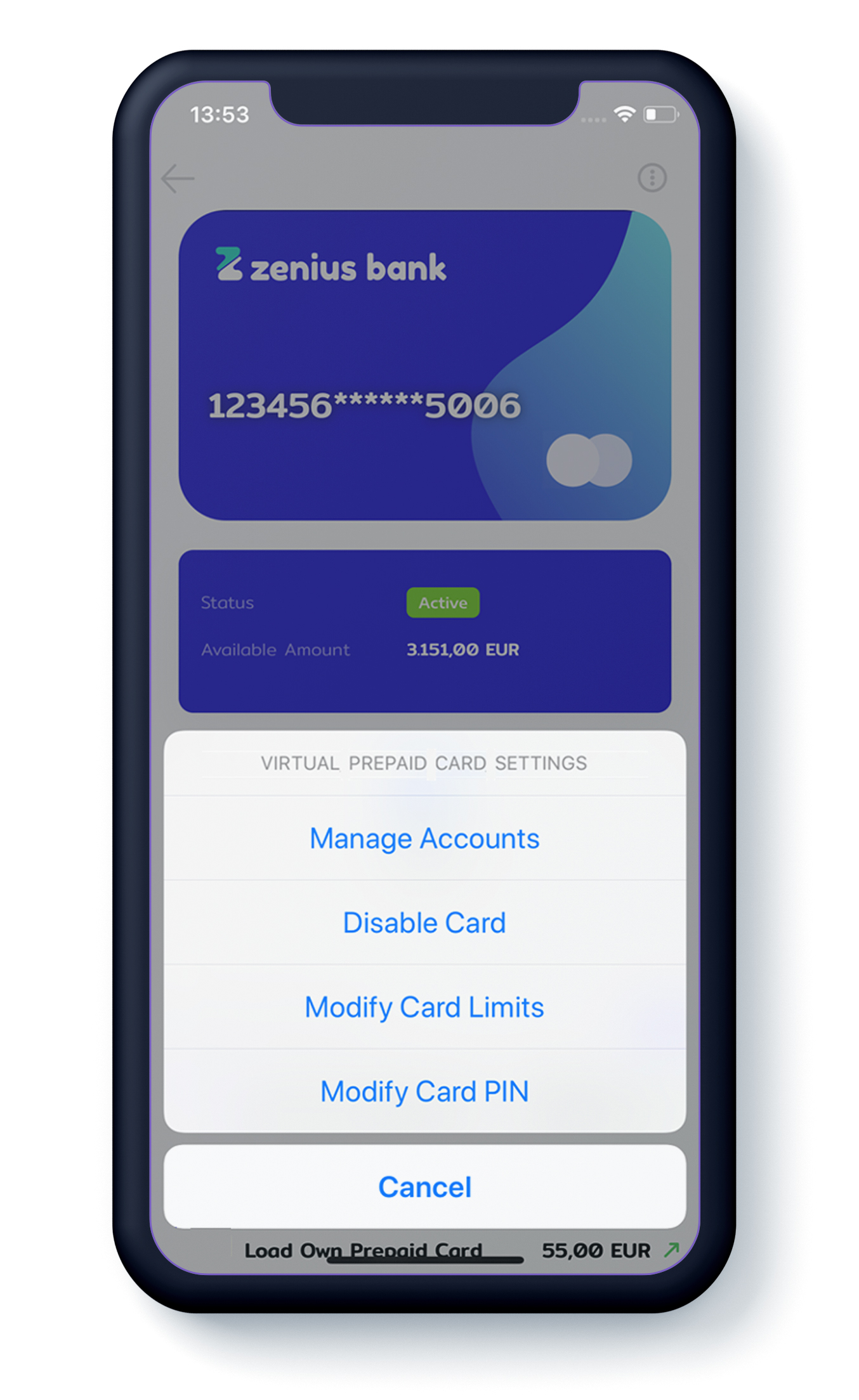

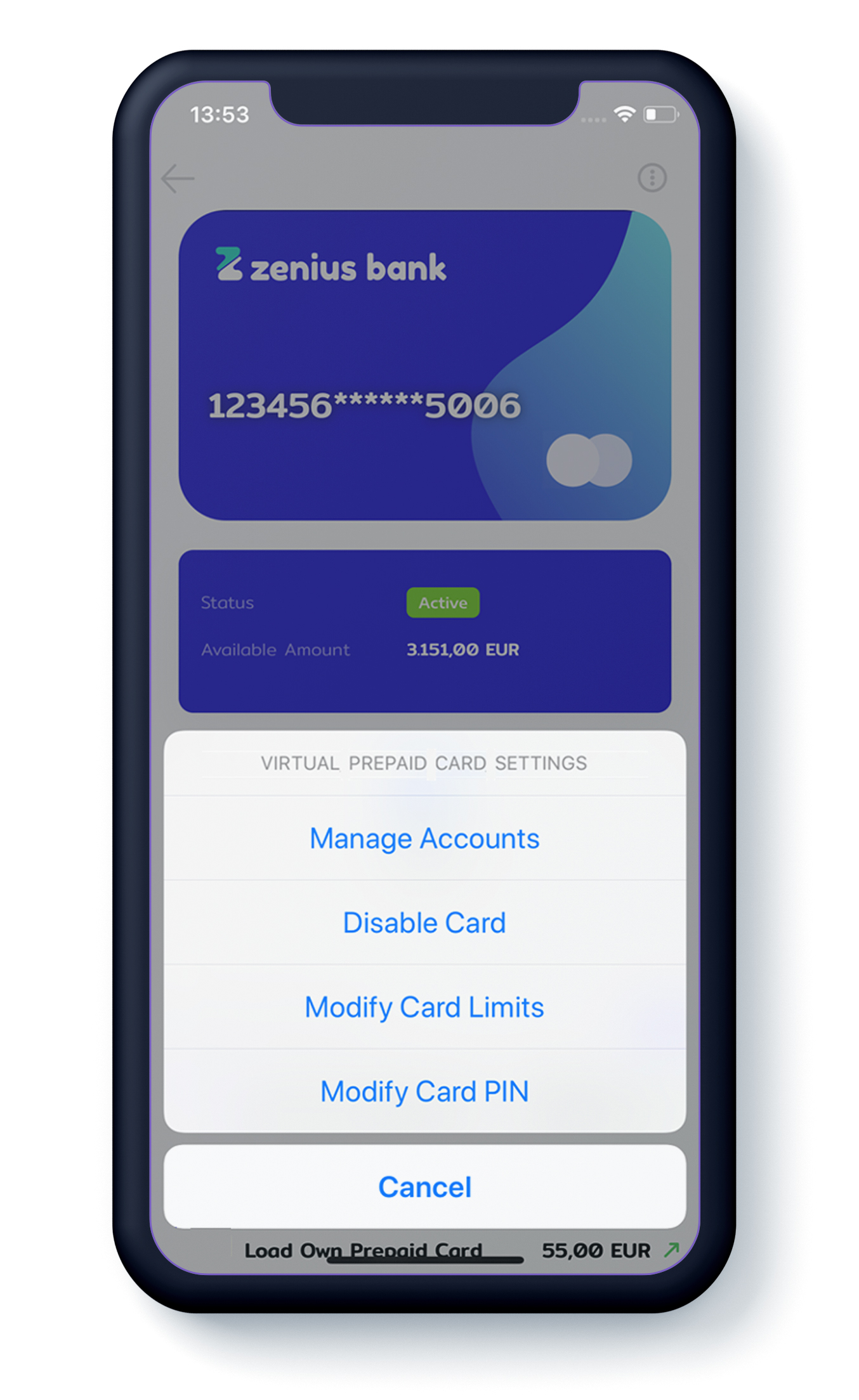

Card Management

Customer lost her card? Forgot her PIN? No need to call the help center anymore. Omnia can help her, declare the card as lost, manage her PIN, specify linked accounts, temporarily deactivate and reactivate it, setup card limits and much more.

Alerts Management

Omnia makes it easy for customers to specify how (email, SMS, push notification) and when (accounts and triggers) they want to receive alerts.

Empower your customers and let them maintain their peace of mind.

Cater for customer self-service

Card Management

Customer lost her card? Forgot her PIN? No need to call the help center anymore. Omnia can help her, declare the card as lost, manage her PIN, specify linked accounts, temporarily deactivate and reactivate it, setup card limits and much more.

Alerts Management

Omnia makes it easy for customers to specify how (email, SMS, push notification) and when (accounts and triggers) they want to receive alerts.

Empower your customers and let them maintain their peace of mind.

Deliver the best UX to your customers

Fully Native Mobile Apps

Omnia delivers 100% native mobile apps for smartphones & tablets, for both iOS & Android. This allows you to benefit from the native platform capabilities and provide:

- Full support of Biometric Authentication (fingerprint, Face ID) for SCA, Quick Login and Transactions Authorization

- Actionable Push Notifications allowing for cross-channel transactions authorization with two taps.

- Optimized User experience incorporating native support for smooth transitions, swipe gestures, camera, contact list and GPS Access

Deliver the best UX to your customers

Fully Native Mobile Apps

Omnia delivers 100% native mobile apps for smartphones & tablets, for both iOS & Android. This allows you to benefit from the native platform capabilities and provide:

- Full support of Biometric Authentication (fingerprint, Face ID) for SCA, Quick Login and Transactions Authorization

- Actionable Push Notifications allowing for cross-channel transactions authorization with two taps.

- Optimized User experience incorporating native support for smooth transitions, swipe gestures, camera, contact list and GPS Access

EASY TO LAUNCH AND MAINTAIN

Discover how your team can comfortably configure, monitor and support Omnia.

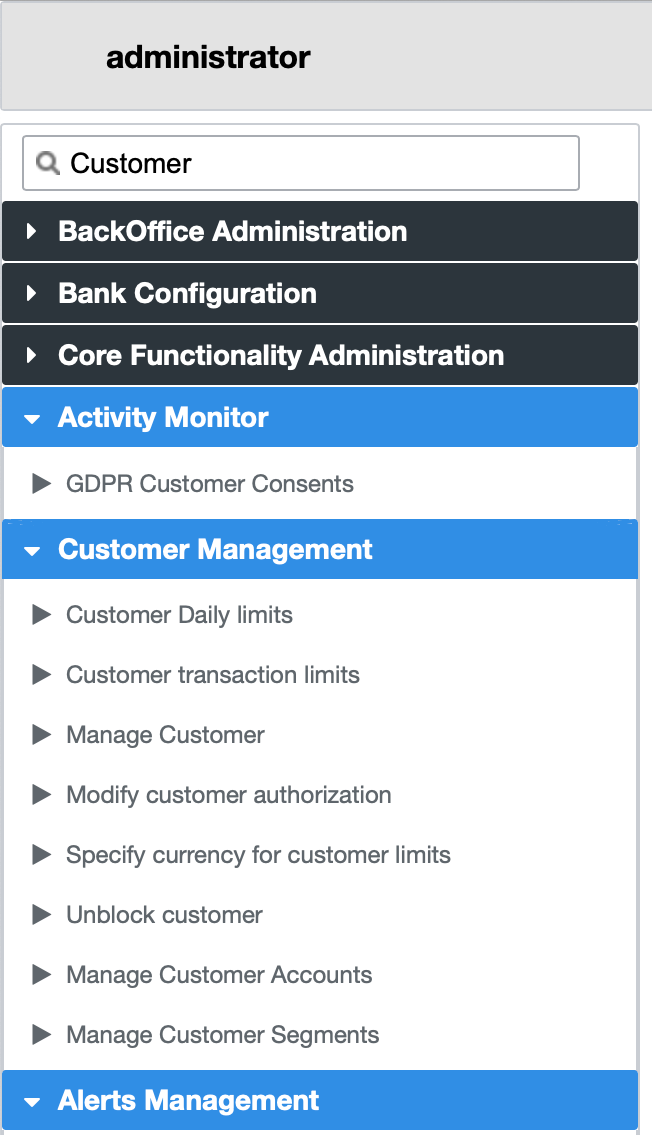

Customer Management

Manage customer groups / profile templates, available channels, limits, offers, GDPR Consent management, etc.

Security Management

Manage how your end customers login and authorize transactions. Use static passwords, OTPs (via SMS, software & hardware tokens) or challenge-response mechanisms.

Alerts Management

Setup & configure the alerts content, delivery settings (through SMS, email or Push Notifications) and customer segments that receive each alert. View detailed alert delivery logs.

Build on top of the pre-configured alerts that come with Omnia.

Customer Service Requests

Review and service customer applications that require manual processing. Allow customers to apply for new cheque books, letters of credit, and letters of guarantee, and notify them when ready.

Customer communications

Interact with customers, inside Omnia in a secure manner. Use pre-configured topics to streamline requests and accept attachments.

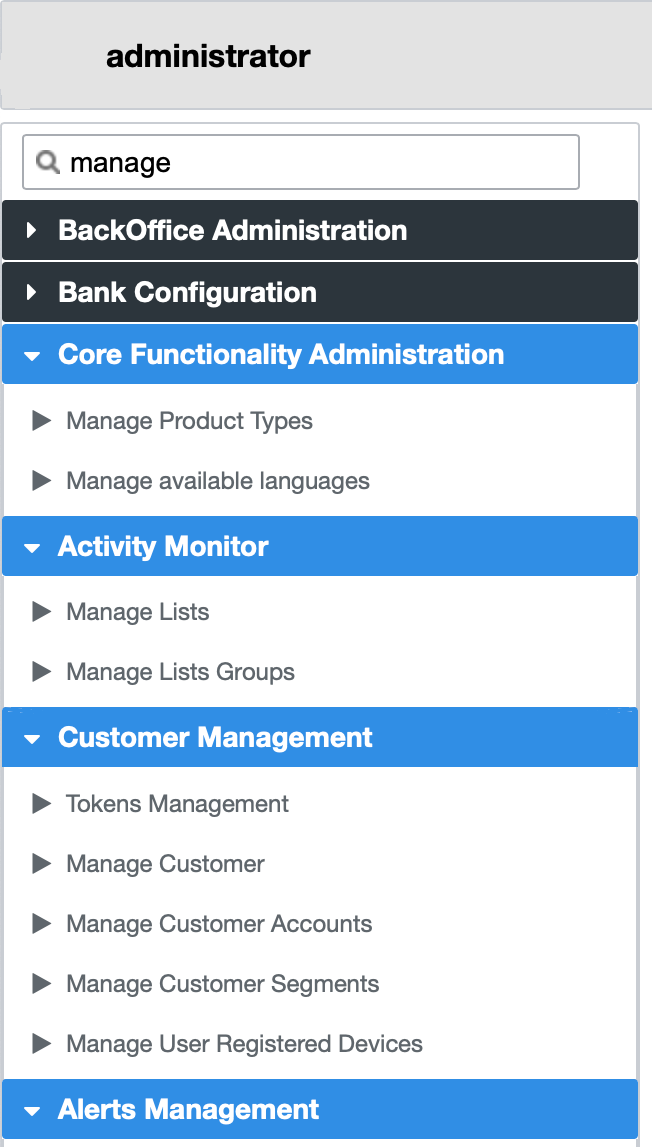

Role-based access control

Setup of departments, roles, and dual control access levels (4-eyes principle).

Product Management

Manage what core-banking products appear within Omnia, as well as their type and marketing attributes (i.e naming, offers etc.).

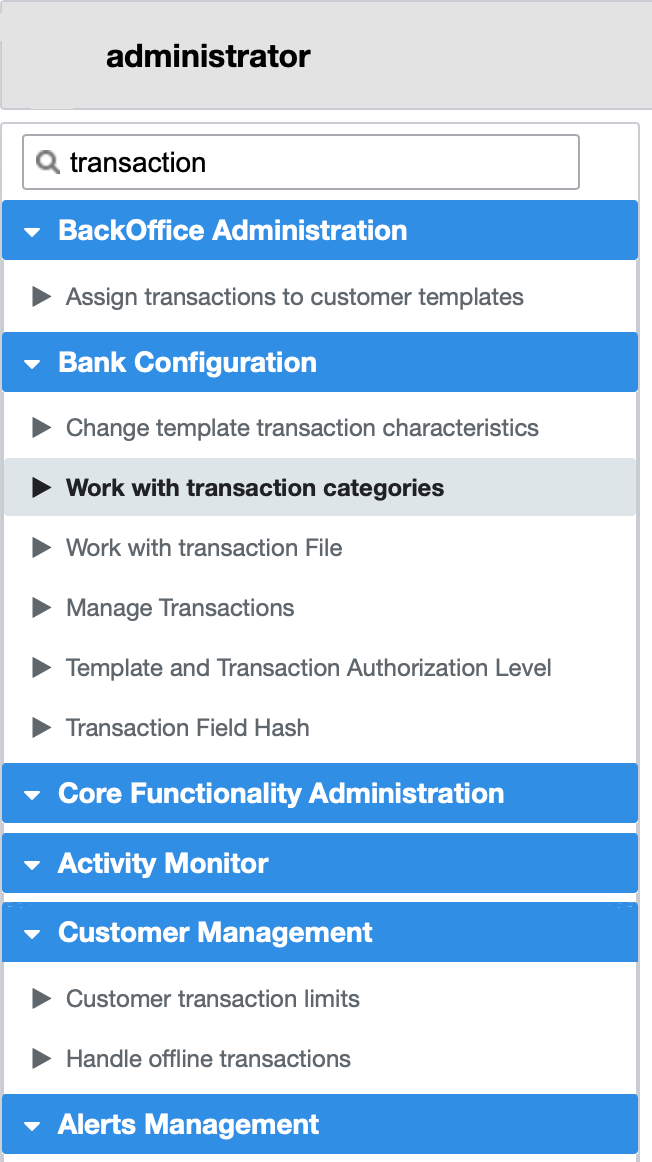

Transaction Management

Handle transaction parameters such as access levels, currency rules, supporting files, BOP codes, limits.

Content Management

Define the content available in Omnia, including languages, tooltips, terms & conditions (per transaction), drop down lists, fields & menu items, and much more.

Auditing & Logging

Audit the actions of all Omnia users; either customers using the digital banking applications, or bank personnel using the back office tools.

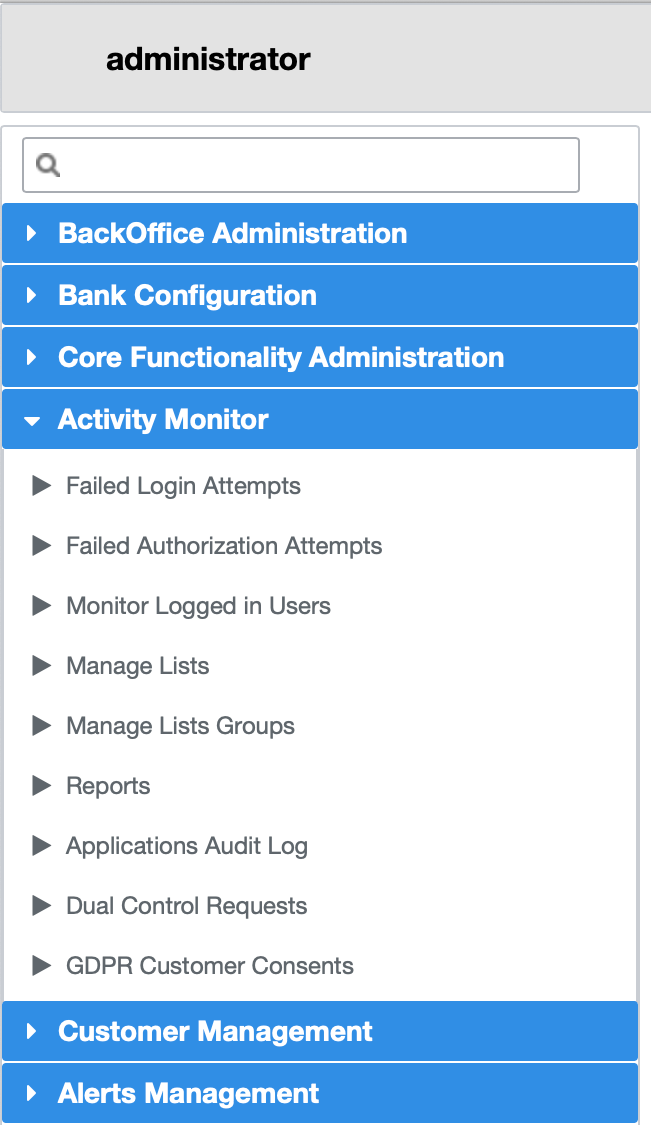

Activity Monitor

Built-in, real-time reporting.

- Detailed transaction analysis

- Monetary transactions

- Bill payments

- Group payments

- Customer modifications

- Alerts & customer notifications

- Failed authorization & authentication attempts

- Logged in users

EASY TO LAUNCH AND MAINTAIN

Discover how your team can comfortably configure, monitor and support Omnia.

Customer Management

Customer Management

Manage customer groups / profile templates, available channels, limits, offers, GDPR Consent management, etc.

Security Management

Manage how your end customers login and authorize transactions. Use static passwords, OTPs (via SMS, software & hardware tokens) or challenge-response mechanisms.

Alerts Management

Setup & configure the alerts content, delivery settings (through SMS, email or Push Notifications) and customer segments that receive each alert. View detailed alert delivery logs.

Build on top of the pre-configured alerts that come with Omnia.

Customer Servicing

Customer Service Requests

Review and service customer applications that require manual processing. Allow customers to apply for new cheque books, letters of credit, and letters of guarantee, and notify them when ready.

Customer communications

Interact with customers, inside Omnia in a secure manner. Use pre-configured topics to streamline requests and accept attachments.

Omnia Configuration

Role-based access control

Setup of departments, roles, and dual control access levels (4-eyes principle).

Product Management

Manage which core-banking products appear within Omnia, as well as their type and marketing attributes (i.e naming, offers etc.).

Transaction Management

Handle transaction parameters such as access levels, currency rules, supporting files, BOP codes, limits.

Content Management

Define the content available in Omnia, including languages, tooltips, terms & conditions (per transaction), drop down lists, fields & menu items, and much more.

Real-time monitoring

Auditing & Logging

Audit the actions of all Omnia users; either customers using the digital banking applications, or bank personnel using the back office tools.

Activity Monitor

Built-in, real-time reporting.

- Detailed transaction analysis

- Monetary transactions

- Bill payments

- Group payments

- Customer modifications

- Alerts & customer notifications

- Failed authorization & authentication attempts

- Logged in users